High growth trend, Maersk announced the second quarter results

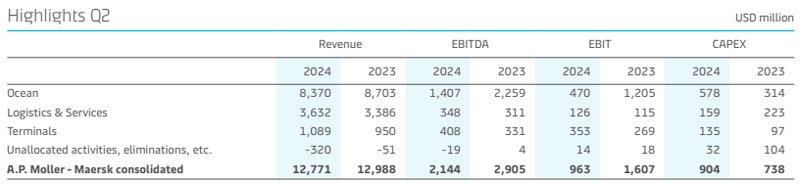

Thanks to improved profitability in the Marine business, solid growth in the Logistics & Services business and excellent performance in the terminal business, A.P. Maersk continued its growth momentum in the second quarter of 2024: volumes increased across all businesses, the financial performance was stronger, and the EBIT margin reached 7.5% (compared to 1.4% in the first quarter). Based on the ongoing impact of the Red Sea crisis and strong market demand, Maersk raised its financial results guidance for 2024 on August 1.

Vincent Clerc, Chief Executive Officer of A.P. Moller-Maersk, said: "This quarter's performance proves that all of our businesses are moving in the right direction. Market demand is high, the situation in the Red Sea region remains critical, and the global supply chain is under continued pressure. We expect this to continue throughout the year. We have invested heavily in adding new equipment to our businesses to better adapt to market conditions and support our customers in the face of supply chain disruptions. Looking ahead, our focus remains on sustaining organic growth while exploring opportunities for value-adding acquisitions, particularly in the logistics space. We will continue to maintain tight cost control, maintain high asset utilization, and further drive fleet renewal."

The Logistics and Services business increased 7% compared to the same period last year, with higher volumes across product lines and gains offsetting low freight rates. Profitability in the Logistics & Services business improved both sequentially and year-over-year, driven by improved asset utilization, effective cost control, and the company's progress in resolving customer implementation issues in North America.

In the terminal business, cargo volume continues to grow, especially in North America. The increase in rates and storage fees resulted in a significant increase in revenue per natural tank, while operating costs increased only slightly. Effective cost management and strong revenue boosted earnings at the terminal business, with earnings before depreciation and amortisation (EBITDA) in line with all-time highs.

2024 Financial Performance guidance

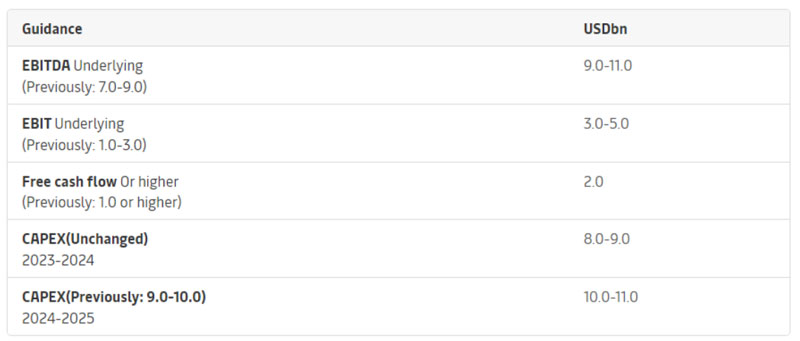

In accordance with the August 1 announcement, Maersk has raised its financial results guidance for 2024 due to the ongoing supply chain disruptions caused by the situation in the Red Sea and Gulf of Aden and strong container market demand, as shown in the table below. Maersk now expects the global container market to grow between 4% and 6%, and the company's business will grow at the same level as the market. Previously, Maersk expected the growth of the global container market to be between 2.5% and 4.5%.

In addition, to support fleet renewal, Maersk now expects capital expenditure in 2024-2025 to be between $10 billion and $11 billion (previously between $9 billion and $10 billion).

Vincent Clerc, Chief Executive Officer of A.P. Moller-Maersk, said: "This quarter's performance proves that all of our businesses are moving in the right direction. Market demand is high, the situation in the Red Sea region remains critical, and the global supply chain is under continued pressure. We expect this to continue throughout the year. We have invested heavily in adding new equipment to our businesses to better adapt to market conditions and support our customers in the face of supply chain disruptions. Looking ahead, our focus remains on sustaining organic growth while exploring opportunities for value-adding acquisitions, particularly in the logistics space. We will continue to maintain tight cost control, maintain high asset utilization, and further drive fleet renewal."

The Logistics and Services business increased 7% compared to the same period last year, with higher volumes across product lines and gains offsetting low freight rates. Profitability in the Logistics & Services business improved both sequentially and year-over-year, driven by improved asset utilization, effective cost control, and the company's progress in resolving customer implementation issues in North America.

In the terminal business, cargo volume continues to grow, especially in North America. The increase in rates and storage fees resulted in a significant increase in revenue per natural tank, while operating costs increased only slightly. Effective cost management and strong revenue boosted earnings at the terminal business, with earnings before depreciation and amortisation (EBITDA) in line with all-time highs.

2024 Financial Performance guidance

In accordance with the August 1 announcement, Maersk has raised its financial results guidance for 2024 due to the ongoing supply chain disruptions caused by the situation in the Red Sea and Gulf of Aden and strong container market demand, as shown in the table below. Maersk now expects the global container market to grow between 4% and 6%, and the company's business will grow at the same level as the market. Previously, Maersk expected the growth of the global container market to be between 2.5% and 4.5%.

In addition, to support fleet renewal, Maersk now expects capital expenditure in 2024-2025 to be between $10 billion and $11 billion (previously between $9 billion and $10 billion).

A.P. Moller - Maersk's financial results for 2024 are subject to macroeconomic, fuel prices, freight rates and other uncertainties. Other conditions being equal, the sensitivity analysis of the four core factors to profit is as follows: