Ranking the world's container terminal operators, MSC has the highest growth rate

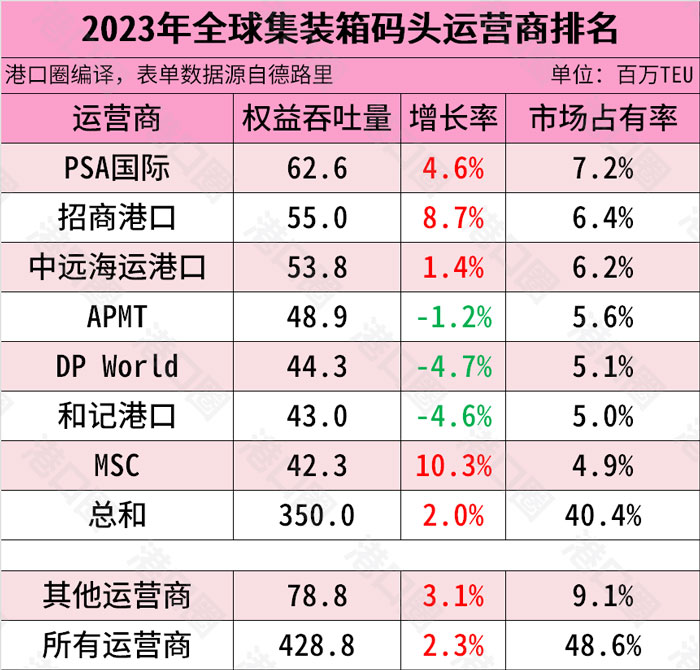

According to Delury's Annual Review and Forecast for Global Container Terminal Operators (2024/25) report, ranked by equity throughput, The World's top seven container terminal operators in 2023 are PSA International, China Merchants Port, COSCO Shipping Port, APMT (Maersk Terminal), DP World (Dubai World), Hutchison Ports and MSC (Mediterranean Shipping).

The top seven terminal operators handle more than 40% of the world's container throughput and each has an equity throughput of more than 40 million TEU, opening up a huge gap of nearly 30 million TEU with other smaller operators.

PSA International completed equity throughput of 62.6 million TEU in 2023, an increase of 4.6%, and its market share rose to 7.2%. This was driven by throughput growth at its home port of Singapore, which completed 39.01 million TEU of containers in 2023, an increase of 4.6% year-on-year and a record.

From the perspective of overseas investment, PSA International gradually tilted its direction and successively invested in Turkey (ALISAN), Vietnam (Sotrans Group) and Bangladesh logistics company; Cooperation with railway companies in Kazakhstan and Indonesia; Invest in the Duisburg terminal and build a logistics park in Dammam Port. PSA International has gone inland, investing in logistics solutions and recently acquired a Polish intermodal logistics company.

China Merchants Port rose one place compared with 2022, and the position of COSCO Shipping port was exchanged. The stable growth of mainland port throughput in 2023 will help the equity throughput growth of the two major Chinese port operators. In fact, in addition to MSC, among the top seven operators, only PSA International, China Merchants Port and COsco Shipping Port, which are focused on East Asia or Southeast Asia, have achieved growth, in addition to the decline in the performance of European and American ports in 2023, the prosperity of intra-Asian trade is also an important factor.

China Merchants Port's year-on-year growth rate was as high as 8.7%. In the mainland, Shanghai Port, Ningbo Zhoushan Port, Qingdao Port QQCTU is the main source of investment port, in September 2022, China Merchants Port officially became the second largest shareholder of Ningbo Port (23.08%), in 2023, Ningbo Port contributed a lot of equity throughput. Overseas, terminals such as TCP in Brazil and PDSA in Djibouti have also achieved substantial growth in container throughput.

In addition, in 2023, the attributes of the overseas investment platform of China Merchants Port (00144.HK) are more clear, first listing the transfer of 45% of the shares of Daxeh Terminal, and then investing in the South Asia Trade logistics Center project, buying 51% of the shares of Indonesian terminal operators, after the epidemic, the port returned to the track of overseas investment.

On the one hand, COSCO Shipping Port strengthened the resource integration of the main control terminal and supply chain business. After a series of acquisitions, it controlled Xiamen Yuanhai Terminal and a supply chain company to build a comprehensive logistics hub of the port. Through the linkage of domestic terminals and station resources such as Xiamen Yuanhai and Overseas Zeebruch, the digital platform of automobile supply chain has been launched and a variety of supply chain products have been developed.

On the other hand, due to the changes in the overseas investment environment, COSCO Shipping Ports has participated in more projects. Whether it is the completion of the investment in the Port of Hamburg CTT terminal, or the investment in the Egyptian Greenland terminal project with Hutchison Ports and CMA CGM, the equity proportion is less than 25%.

The equity throughput of APMT, DP World and Hutchison ports has declined to varying degrees, and these three port operators all have large master terminals in developed regions. In 2023, the decline in throughput of major ports in Europe and the United States has dragged down their performance. Hutchison Port also takes into account the impact of the port of Hong Kong, where the combined terminal throughput of Hutchison Port Trust in 2023 declined by 14.7% year-on-year.

Among the business units of Maersk, the terminal business has relatively little capital investment, and APMT focuses on the equipment renewal and expansion of existing terminals, its largest project is the expansion of the Port of Rotterdam Masplain II terminal, and its Port Said SCCT in Egypt will also be expanded. DP World has significantly shifted its terminal expansion toward emerging markets, making huge investments in East Africa, Indonesia, India and elsewhere, and in June announced plans to spend $3 billion over the next three to five years on new port and logistics infrastructure in Africa. As a veteran port operator, Hutchison Ports began to develop more brownfield or greenfield projects with shipping companies, jointly expand the Port of Rotterdam terminal with MSC, and jointly develop the Egyptian terminal with CMA CGM and COSCO Shipping.

Among the top seven operators, MSC saw the highest growth due to strong growth in equity throughput from the acquisition of Bollore Africa (renamed AGL) in December 2022. MSC has two existing terminal platforms, TiL and AGL. After breaking up with Maersk, MSC has increased terminal investment. When it completes the equity delivery of HHLA, the largest terminal operator in the Port of Hamburg, its equity throughput and ranking may further rise.

In terms of revenue and expenditure, although dock charges have risen due to inflation, global ports are no longer congested in 2023, leading to a return to normal levels of operator warehousing revenue. However, after the Red Sea crisis, the cost of storage caused by congestion increased again. In terms of expenditure, total capital expenditure (capex) of the terminal operators sampled by Delury was $5.5 billion, up 9% year-on-year and up for the third consecutive year since 2020, with five major operators spending more than $500 million on terminal expansion and equipment renewal projects, with PSA International and DP World spending more than $1 billion.

The top seven terminal operators handle more than 40% of the world's container throughput and each has an equity throughput of more than 40 million TEU, opening up a huge gap of nearly 30 million TEU with other smaller operators.

PSA International completed equity throughput of 62.6 million TEU in 2023, an increase of 4.6%, and its market share rose to 7.2%. This was driven by throughput growth at its home port of Singapore, which completed 39.01 million TEU of containers in 2023, an increase of 4.6% year-on-year and a record.

From the perspective of overseas investment, PSA International gradually tilted its direction and successively invested in Turkey (ALISAN), Vietnam (Sotrans Group) and Bangladesh logistics company; Cooperation with railway companies in Kazakhstan and Indonesia; Invest in the Duisburg terminal and build a logistics park in Dammam Port. PSA International has gone inland, investing in logistics solutions and recently acquired a Polish intermodal logistics company.

China Merchants Port rose one place compared with 2022, and the position of COSCO Shipping port was exchanged. The stable growth of mainland port throughput in 2023 will help the equity throughput growth of the two major Chinese port operators. In fact, in addition to MSC, among the top seven operators, only PSA International, China Merchants Port and COsco Shipping Port, which are focused on East Asia or Southeast Asia, have achieved growth, in addition to the decline in the performance of European and American ports in 2023, the prosperity of intra-Asian trade is also an important factor.

China Merchants Port's year-on-year growth rate was as high as 8.7%. In the mainland, Shanghai Port, Ningbo Zhoushan Port, Qingdao Port QQCTU is the main source of investment port, in September 2022, China Merchants Port officially became the second largest shareholder of Ningbo Port (23.08%), in 2023, Ningbo Port contributed a lot of equity throughput. Overseas, terminals such as TCP in Brazil and PDSA in Djibouti have also achieved substantial growth in container throughput.

In addition, in 2023, the attributes of the overseas investment platform of China Merchants Port (00144.HK) are more clear, first listing the transfer of 45% of the shares of Daxeh Terminal, and then investing in the South Asia Trade logistics Center project, buying 51% of the shares of Indonesian terminal operators, after the epidemic, the port returned to the track of overseas investment.

On the one hand, COSCO Shipping Port strengthened the resource integration of the main control terminal and supply chain business. After a series of acquisitions, it controlled Xiamen Yuanhai Terminal and a supply chain company to build a comprehensive logistics hub of the port. Through the linkage of domestic terminals and station resources such as Xiamen Yuanhai and Overseas Zeebruch, the digital platform of automobile supply chain has been launched and a variety of supply chain products have been developed.

On the other hand, due to the changes in the overseas investment environment, COSCO Shipping Ports has participated in more projects. Whether it is the completion of the investment in the Port of Hamburg CTT terminal, or the investment in the Egyptian Greenland terminal project with Hutchison Ports and CMA CGM, the equity proportion is less than 25%.

The equity throughput of APMT, DP World and Hutchison ports has declined to varying degrees, and these three port operators all have large master terminals in developed regions. In 2023, the decline in throughput of major ports in Europe and the United States has dragged down their performance. Hutchison Port also takes into account the impact of the port of Hong Kong, where the combined terminal throughput of Hutchison Port Trust in 2023 declined by 14.7% year-on-year.

Among the business units of Maersk, the terminal business has relatively little capital investment, and APMT focuses on the equipment renewal and expansion of existing terminals, its largest project is the expansion of the Port of Rotterdam Masplain II terminal, and its Port Said SCCT in Egypt will also be expanded. DP World has significantly shifted its terminal expansion toward emerging markets, making huge investments in East Africa, Indonesia, India and elsewhere, and in June announced plans to spend $3 billion over the next three to five years on new port and logistics infrastructure in Africa. As a veteran port operator, Hutchison Ports began to develop more brownfield or greenfield projects with shipping companies, jointly expand the Port of Rotterdam terminal with MSC, and jointly develop the Egyptian terminal with CMA CGM and COSCO Shipping.

Among the top seven operators, MSC saw the highest growth due to strong growth in equity throughput from the acquisition of Bollore Africa (renamed AGL) in December 2022. MSC has two existing terminal platforms, TiL and AGL. After breaking up with Maersk, MSC has increased terminal investment. When it completes the equity delivery of HHLA, the largest terminal operator in the Port of Hamburg, its equity throughput and ranking may further rise.

In terms of revenue and expenditure, although dock charges have risen due to inflation, global ports are no longer congested in 2023, leading to a return to normal levels of operator warehousing revenue. However, after the Red Sea crisis, the cost of storage caused by congestion increased again. In terms of expenditure, total capital expenditure (capex) of the terminal operators sampled by Delury was $5.5 billion, up 9% year-on-year and up for the third consecutive year since 2020, with five major operators spending more than $500 million on terminal expansion and equipment renewal projects, with PSA International and DP World spending more than $1 billion.