Demand for container ship capacity is up 12% this year

Houthi attacks on merchant vessels in the Red Sea region and the large number of ships sailing around the Cape of Good Hope in South Africa remain a central hot topic in the shipping industry this year.

This instability has had a significant impact on the supply and demand of shipping capacity in the region. In a recent report, Clarksons Research pointed out that the Red Sea crisis has brought about a 3% "lift" in tonny-nautical mile demand for the shipping industry as a whole, and about 12% in the container shipping sector.

This also provides significant support for multiple market segments.

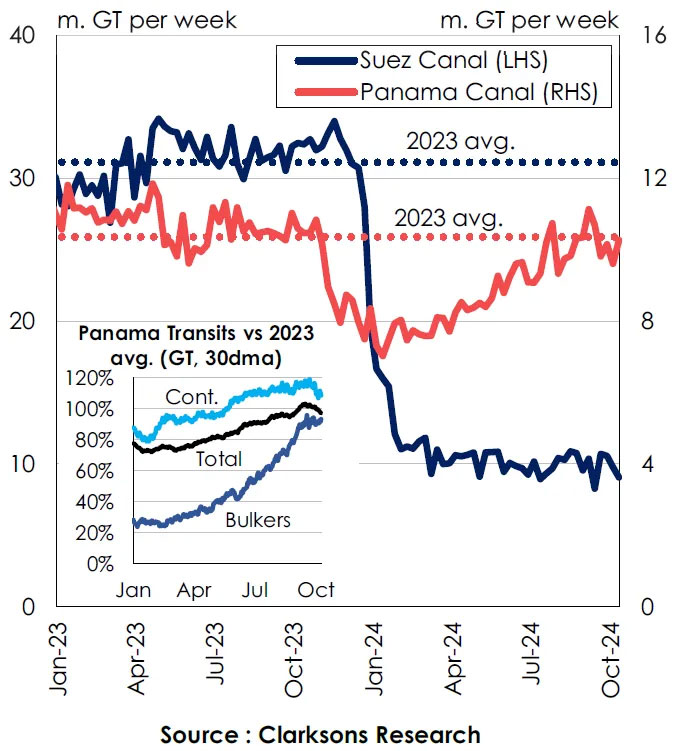

Clarkson's data shows that ship transits in the Suez Canal are down about 70 percent (in gross tons) compared to the 2023 average. While the picture varies by ship type, the overall trend is for cruise, car and LNG carriers to see a decline of around 9%, while bulk carriers and tankers to see a decline of around 40-50%.

The geopolitical situation in the Middle East remains complex and volatile, with most of the world's container carriers re-routing routes to avoid the Red Sea region, a trend Clarkson expects to continue until 2025.

As well as the Suez Canal, there is the Panama Canal. Due to low water levels last year, ship transit through the Panama Canal has been severely restricted. With the gradual relaxation of transit restrictions on the canal, the canal traffic improved by the end of the year.

Ship transit through the Panama Canal reached 10.3 million gross tons in the latest week, reaching the 2023 average and up 35% from this year's January-February low, Clarkson's data show. At present, the total transit volume of the canal has basically returned to close to normal levels, but the performance of different ship types is different. Transit volume of container ships is expected to increase by 12% on average in 2023, while transit volume of bulk carriers is expected to decrease.

The Suez Canal and the Panama Canal are both choke points for the international shipping industry, and the impact of changes in these core areas on the shipping market is clear, so the issue of canal disruption will remain a focus in the coming year.