After falling for 15 weeks, European freight rates rebounded sharply for the first time!

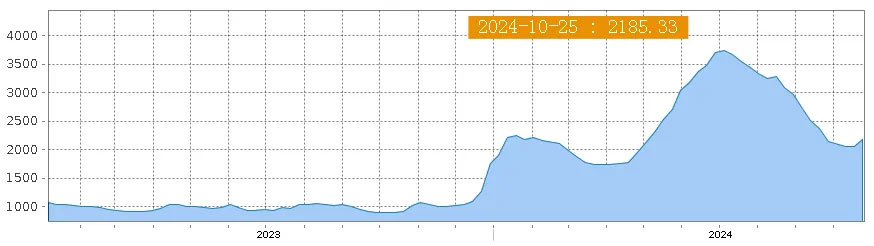

Since July 5, Shanghai export container comprehensive freight index (SCFI) hit a year high of 3733.8 points, the index has fallen for 15 consecutive weeks, but the recent continuous adjustment, the ocean route market freight has rebounded.

On October 25, the SCFI stood at 2,185.3 points, up 6.0% from a week earlier, but down 41.5% from the high of 3,733.8 points.

In terms of European routes, transport demand is generally stable, the supply and demand relationship remains balanced, and shipping companies carry out price increase plans, promoting the booking price in the spot market to rebound sharply.

On October 25, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was US $2226 /TEU, up 14.2% from a week ago; Shanghai port exports to the Mediterranean basic port market freight (sea and sea surcharges) at $2,555 /TEU, also up 10.5% from a week ago.

This is the first rebound after a 15-week decline in European freight rates, but compared with the year's high, European and Mediterranean freight rates have fallen by 54.2% and 53.0%, respectively.

According to data released by Standard & Poor's Global, the preliminary composite PMI for the euro zone in October was 49.7, up 0.1 from the previous value, showing signs of stabilization in the European economy.

Analysts at the Shanghai Shipping Exchange said that although the eurozone manufacturing PMI continued to be depressed, the decline of the German manufacturing industry has eased, and the eurozone service industry continues to grow, which has played a certain role in supporting the weak European economy.

In terms of North American routes, although the rate increase is not as high as that of European routes, there is also a small increase.

On October 25, the freight rate (sea and sea surcharge) of Shanghai port exports to the West and East basic port markets of the United States was 4783 US dollars /FEU and 5099 US dollars /FEU, respectively, up 1.2% and 2.6% from a week ago, but down 41.0% and 48.7% from the year's high, respectively.

Data showed that the U.S. Markit composite PMI rose to 54.3 in October, better than market expectations. Among them, the manufacturing and service industries have recovered slightly from September, indicating that the US economy has shown signs of stabilization. However, analysts at the Shanghai Shipping Exchange believe that as companies worry about the uncertainty brought by the US election, they continue to remain cautious, and the future US economic recovery is still facing a test.

Among them, as tensions in the Persian Gulf region continue to rise, supporting the transport market, freight rates rose sharply. On October 25, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the basic port market of the Persian Gulf was 1,427 US dollars /TEU, up 19.6% from a week ago.

On October 25, the SCFI stood at 2,185.3 points, up 6.0% from a week earlier, but down 41.5% from the high of 3,733.8 points.

Shanghai export container comprehensive freight index chart

In terms of European routes, transport demand is generally stable, the supply and demand relationship remains balanced, and shipping companies carry out price increase plans, promoting the booking price in the spot market to rebound sharply.

On October 25, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was US $2226 /TEU, up 14.2% from a week ago; Shanghai port exports to the Mediterranean basic port market freight (sea and sea surcharges) at $2,555 /TEU, also up 10.5% from a week ago.

This is the first rebound after a 15-week decline in European freight rates, but compared with the year's high, European and Mediterranean freight rates have fallen by 54.2% and 53.0%, respectively.

According to data released by Standard & Poor's Global, the preliminary composite PMI for the euro zone in October was 49.7, up 0.1 from the previous value, showing signs of stabilization in the European economy.

Analysts at the Shanghai Shipping Exchange said that although the eurozone manufacturing PMI continued to be depressed, the decline of the German manufacturing industry has eased, and the eurozone service industry continues to grow, which has played a certain role in supporting the weak European economy.

In terms of North American routes, although the rate increase is not as high as that of European routes, there is also a small increase.

On October 25, the freight rate (sea and sea surcharge) of Shanghai port exports to the West and East basic port markets of the United States was 4783 US dollars /FEU and 5099 US dollars /FEU, respectively, up 1.2% and 2.6% from a week ago, but down 41.0% and 48.7% from the year's high, respectively.

Data showed that the U.S. Markit composite PMI rose to 54.3 in October, better than market expectations. Among them, the manufacturing and service industries have recovered slightly from September, indicating that the US economy has shown signs of stabilization. However, analysts at the Shanghai Shipping Exchange believe that as companies worry about the uncertainty brought by the US election, they continue to remain cautious, and the future US economic recovery is still facing a test.

Among them, as tensions in the Persian Gulf region continue to rise, supporting the transport market, freight rates rose sharply. On October 25, the freight rate (sea freight and sea surcharge) for exports from Shanghai port to the basic port market of the Persian Gulf was 1,427 US dollars /TEU, up 19.6% from a week ago.