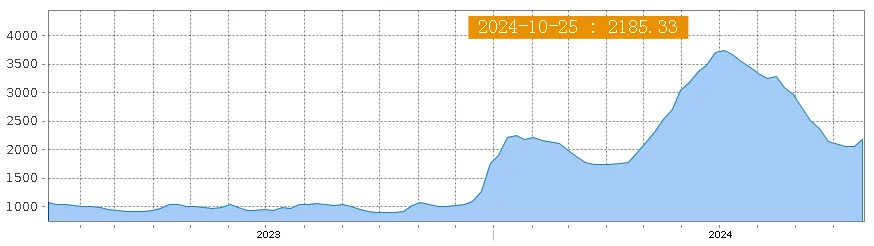

After continuous adjustment in the export container transportation market in the early stage, the freight rate of the ocean route market rebounded, driving the composite index to rise. On October 25, the latest Shanghai export container comprehensive freight index released by the Shanghai Shipping Exchange was 2185.33 points, up 6.0% from the previous period.

The freight rates of the four major ocean routes in Europe and the United States have stopped falling and rebounded, of which the European line has increased significantly.

According to the Shanghai Shipping Exchange released Shanghai export container settlement freight index (European line) data show that since March 25 this year, the freight index (European line) 2153.34 points, all the way to July 22 6318.1 points, 4 months up 193%. This freight rate increase is different from previous freight rate increases. In the past, black swan events such as the Red Sea crisis caused market prices to rise rapidly in the short term, but this freight rate increase has a long time and shows continuity.

The latest data on October 25 shows:

The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the European basic port market was US $2226 /TEU, up 14.2% from the previous period.

Shanghai port exports to the Mediterranean basic port market freight (sea and sea surcharges) is 2555 US dollars /TEU, up 10.5% from the previous period.

Shanghai port exports to the West and east basic port market freight (sea and sea surcharges) were 4783 US dollars /FEU and 5099 US dollars /FEU, respectively, up 1.2% and 2.6% from the previous period.

The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the basic port market of the Persian Gulf is 1,427 US dollars /TEU, up 19.6% from the previous period.

The freight rate (sea freight and sea surcharge) for exports from Shanghai port to the basic port market of Australia and New Zealand was US $2058 /TEU, up 1.6% from the previous period.

The freight rate (sea freight and sea surcharge) for exports from Shanghai port to South America's basic port market was US $6,285 /TEU, up 0.8% from the previous period.

The freight index of China's export route to Japan was 863.35 points, and the freight rate rose slightly.

Recently, Mediterranean Shipping, Maersk, CMA CGM, Hapag-Lloyd and other leading shipping companies have issued a tariff adjustment announcement effective from November.

Diamond Class Freight (DT) - Asia to Europe

Maersk

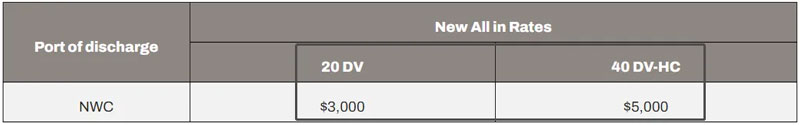

1) Peak Season surcharge - Asia to Saudi Arabia

Vietnam to Saudi Arabia effective November 2, 2024, Taiwan to Saudi Arabia effective November 17, 2024, and other regions effective November 1, 2024.

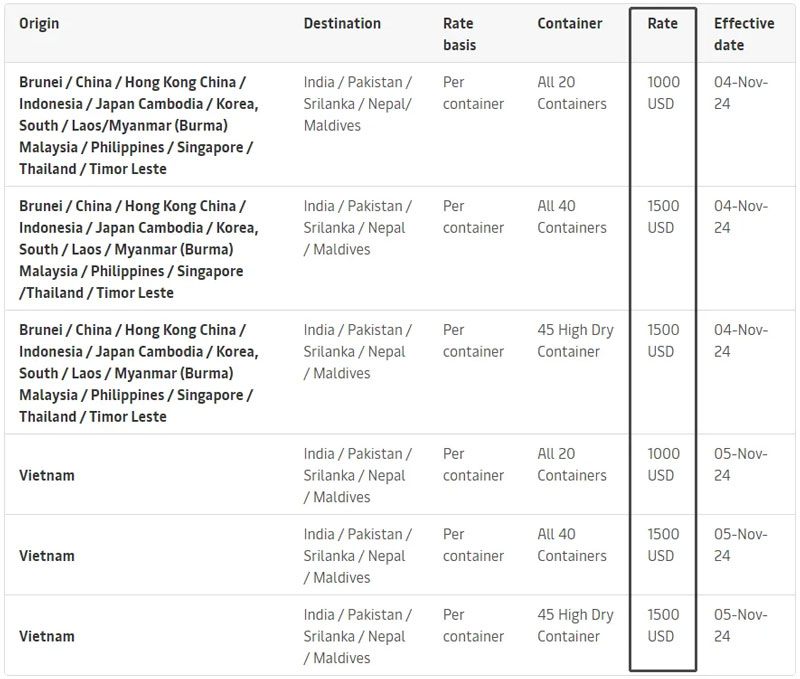

2) Peak season surcharge - Far East Asia to India, Pakistan, Sri Lanka and Maldives

Shanghai, China to Jawaharlal Nehru

Cma Cma

FAK rates - from Asia to Mediterranean and North Africa

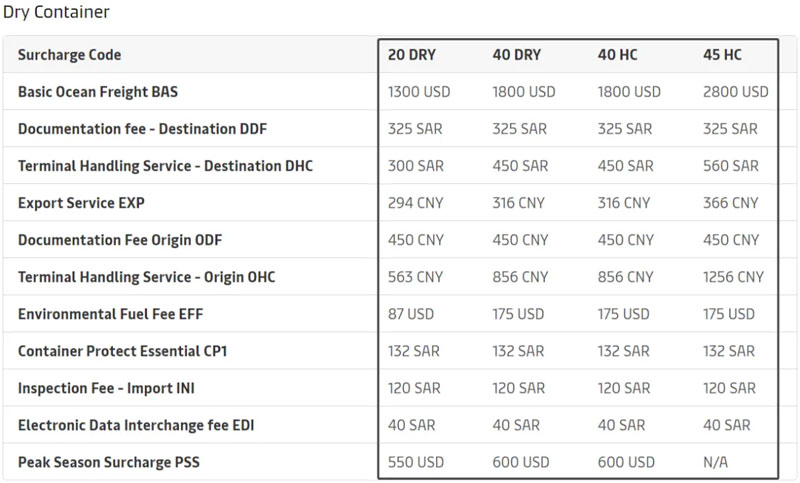

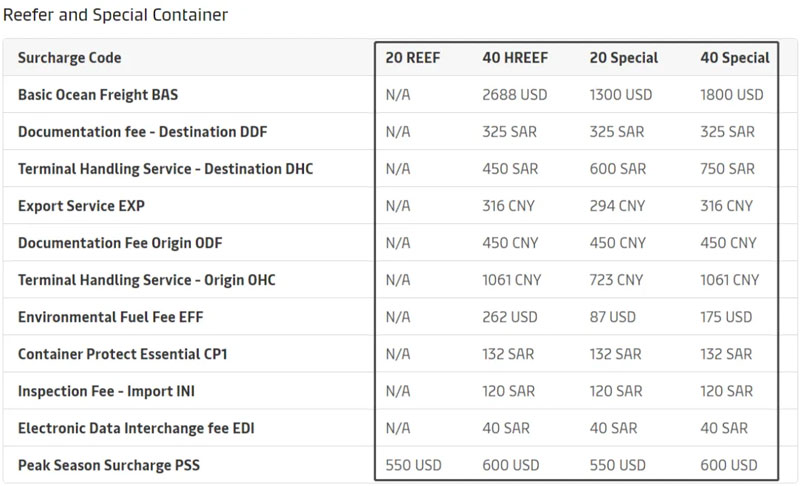

New CMA CGM All Types of Freight (FAK) rates (*) applicable from 1 November 2024 (date of loading at port of origin) until further notice.

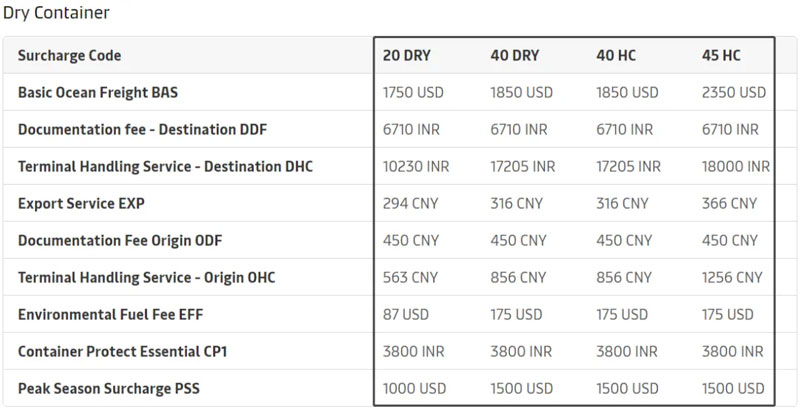

Hapag-Lloyd

1) FAK Rates - Far East to Europe

Suitable for 20' and 40' dry and refrigerated container shipments, including tall containers. Effective November 1, 2024.

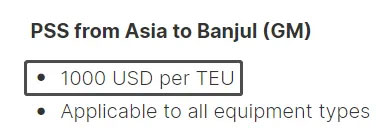

2) Peak Season surcharge - Asia to Banjul

Effective from 1 November 2024 and valid until further notice.

ZIM

High season surcharge - Far East to Eastern Mediterranean, Western Mediterranean, Black Sea (excluding Russian trade) and Northern Europe. Effective from 1st November until further notice.

In addition, the latest edition of Drury's WCI Composite index fell 4% to $3,095 per FEU, which is 70% below the last pandemic peak of $10,377 in September 2021, but 118% above the 2019 (pre-pandemic) average of $1,420.

The year-to-date average composite index is $4,036 per FEU, $1,200 above the 10-year average of $2,836.