Trump tariff war is about to open, the shipping industry how to cope?

Peter Sander, chief analyst at Xeneta, warned that Trump's re-election would send the shipping industry - a global industry that relies on international trade - "down the wrong path."

Earlier this month, Donald Trump won a second term in the White House. During his campaign, Mr Trump promised an economic policy that promised to revive US manufacturing and crack down on what the US sees as unfair Chinese trade practices.

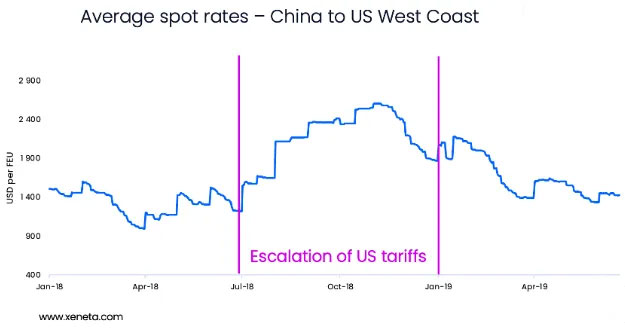

The last time Mr. Trump imposed tariffs on Chinese imports during his trade war in 2018, shipping container rates soared by more than 70 percent, putting increasing pressure on global seaborn supply chains.

To avoid potential new tariffs, most U.S. businesses are likely to import goods ahead of schedule.

Pre-stocking versus 2018: More goods are likely to be imported in advance this time around than when Trump first imposed tariffs in 2018. In 2018, the tariffs were implemented in batches, targeting specific goods, with two months or more to prepare before the tariffs were implemented. But this time is different, with all tariffs likely to be implemented immediately after Trump takes office on January 20, a much shorter window.

Changes in tariff levels: In 2018, tariffs on goods from China were 25 percent, and now Trump plans to impose tariffs of up to 20 percent on all goods imported into the United States, and more than 60 percent on Chinese imports. That means there is a stronger incentive to load early.

Port strike risk: In addition, there is also the risk of a possible strike at U.S. East Coast and Gulf Coast ports in January to consider.

Freight pressure: Since October 15, average spot freight rates from the Far East to the West Coast of the United States may have fallen by 6.9%, while average spot freight rates to the East Coast of the United States have fallen by 1.5%. However, companies that had waited for the election results before deciding to ship early are now more likely to act. That would mean a sudden increase in demand on major trade routes into the United States, putting upward pressure on freight rates and available capacity on some trade routes.

Risk mitigation strategies: Companies should use data to track freight trends and compare their prices with those of peers, carriers and freight forwarders. In addition, monitoring the rates between different traded goods is also critical, especially when considering importing alternative ports to the United States.

Long-term supply chain impact: In the coming months and years, if the trade war intensifies, some companies may seek to diversify their supply chains, shifting imports to the United States through alternative trade. Mexico is likely to receive more attention as a gateway for U.S. imports, as shipments from China to Mexico grow significantly in 2024. Moreover, Trump's tariff policies could trigger similar responses from other countries and trading blocs, such as the European Union, against China.

As a Chinese export enterprise, it should pay close attention to the dynamic changes of Trump's tariff policy, obtain and analyze relevant market information in a timely manner, and accurately predict future market demand in order to adjust production plans and export strategies. On the other hand, we actively expand markets in other countries and regions other than the United States, reduce our dependence on the American market, and explore emerging markets such as Southeast Asia and Africa to diversify export risks. Develop flexible contingency plans and strengthen information communication with shipping companies, freight forwarders and other partners in a timely manner to reduce potential risks and ensure supply chain stability.

Earlier this month, Donald Trump won a second term in the White House. During his campaign, Mr Trump promised an economic policy that promised to revive US manufacturing and crack down on what the US sees as unfair Chinese trade practices.

The last time Mr. Trump imposed tariffs on Chinese imports during his trade war in 2018, shipping container rates soared by more than 70 percent, putting increasing pressure on global seaborn supply chains.

To avoid potential new tariffs, most U.S. businesses are likely to import goods ahead of schedule.

Pre-stocking versus 2018: More goods are likely to be imported in advance this time around than when Trump first imposed tariffs in 2018. In 2018, the tariffs were implemented in batches, targeting specific goods, with two months or more to prepare before the tariffs were implemented. But this time is different, with all tariffs likely to be implemented immediately after Trump takes office on January 20, a much shorter window.

Changes in tariff levels: In 2018, tariffs on goods from China were 25 percent, and now Trump plans to impose tariffs of up to 20 percent on all goods imported into the United States, and more than 60 percent on Chinese imports. That means there is a stronger incentive to load early.

Port strike risk: In addition, there is also the risk of a possible strike at U.S. East Coast and Gulf Coast ports in January to consider.

Freight pressure: Since October 15, average spot freight rates from the Far East to the West Coast of the United States may have fallen by 6.9%, while average spot freight rates to the East Coast of the United States have fallen by 1.5%. However, companies that had waited for the election results before deciding to ship early are now more likely to act. That would mean a sudden increase in demand on major trade routes into the United States, putting upward pressure on freight rates and available capacity on some trade routes.

Risk mitigation strategies: Companies should use data to track freight trends and compare their prices with those of peers, carriers and freight forwarders. In addition, monitoring the rates between different traded goods is also critical, especially when considering importing alternative ports to the United States.

Long-term supply chain impact: In the coming months and years, if the trade war intensifies, some companies may seek to diversify their supply chains, shifting imports to the United States through alternative trade. Mexico is likely to receive more attention as a gateway for U.S. imports, as shipments from China to Mexico grow significantly in 2024. Moreover, Trump's tariff policies could trigger similar responses from other countries and trading blocs, such as the European Union, against China.

As a Chinese export enterprise, it should pay close attention to the dynamic changes of Trump's tariff policy, obtain and analyze relevant market information in a timely manner, and accurately predict future market demand in order to adjust production plans and export strategies. On the other hand, we actively expand markets in other countries and regions other than the United States, reduce our dependence on the American market, and explore emerging markets such as Southeast Asia and Africa to diversify export risks. Develop flexible contingency plans and strengthen information communication with shipping companies, freight forwarders and other partners in a timely manner to reduce potential risks and ensure supply chain stability.