The share of imported coal has fallen sharply, and bulk carriers have suffered

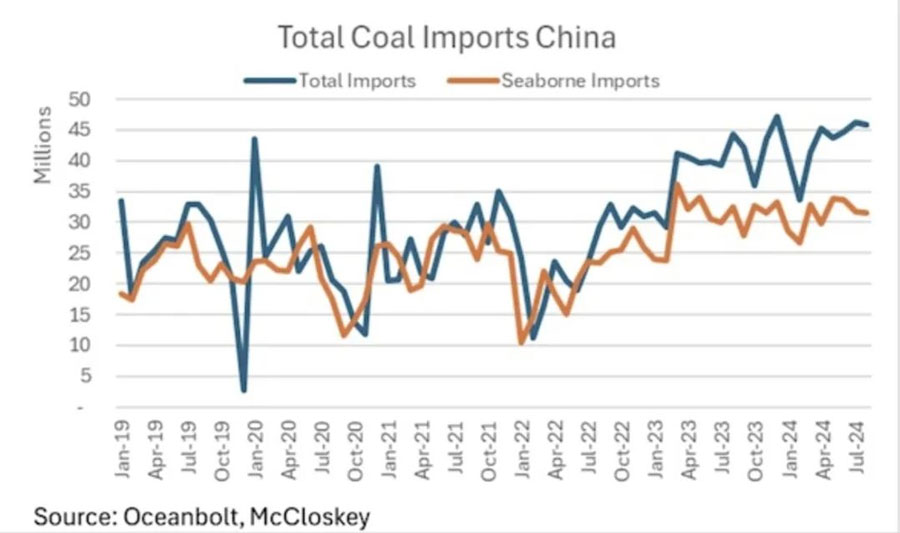

According to a new report from Oceanbolt, a commodity market intelligence provider owned by Veson Nautical, the share of coal imported by sea has fallen sharply in the past two years, from 93 percent in 2015-2022 to 76 percent in 2023-2024.

While China's overall coal imports will jump 62 per cent to 473 million tonnes in 2023, seaborne imports will grow only 45 per cent, the report said. The data points to a sea change in global trade flows as China looks to diversify its supply away from traditional exporters and take advantage of geopolitical uncertainty to buy low-priced coal from other sources.

Australia's coal exports were once heavily dependent on the Chinese market. However, since 2019, Australia's share of China's coal import market has plummeted from 26 per cent to 11 per cent in 2023. The core reason behind this trend is the legacy effect of the Australian coal ban.

While Chinese imports of Australian thermal coal picked up after trade resumed in 2023, the picture for coking coal was bleak. In 2023, China imported just 2.8 million tonnes of Australian coking coal, a 91 per cent plunge from before the ban.

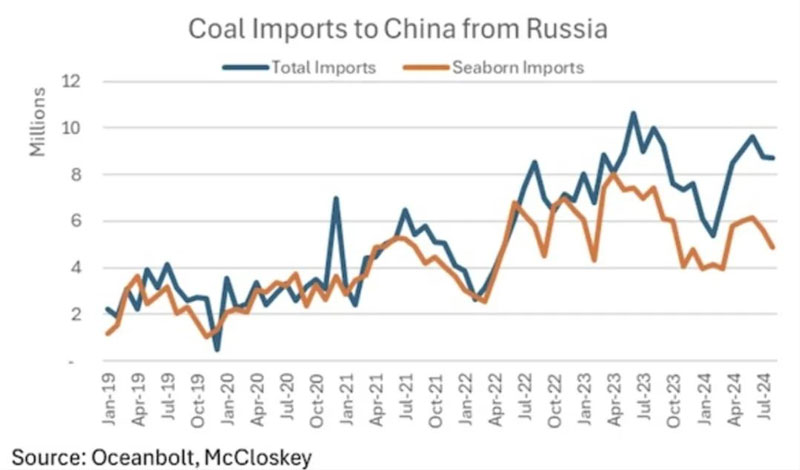

The report notes that Russia is a growing supplier of coal to China. In 2019, Russia's share of China's coal import market was only 11%, but by 2023 it had soared to 22%. This change is closely related to the war between Russia and Ukraine and the sanctions imposed on Russia by Western countries.

According to him, Russian coal exports to China increased by 34 million tons between 2022 and 2023, but only 18.7 million tons of this was transported by sea, which means 15.3 million tons were transported by land, further weakening the growth potential of the seaborne market.

Mongolia's rise to power

As an upstart in China's coal import market, Mongolia is breaking bottlenecks with its upgrading infrastructure. Mongolia exports about 90 per cent of its coal production, and its biggest buyer is China.

According to the Mongolian Coal Association, the country's coal production potential is as high as 100 million tons per year. However, this capability is limited by border infrastructure and customs procedures. In 2023, Mongolia took significant steps to increase its coal export capacity, including the opening of a new rail line linking its coal mines to the Chinese border.

The rise of overland supply chains is rapidly squeezing Australia's market share in coking coal and directly displacing the traditional maritime model.

Ton-nautical mile loss of seaborne coal

With the expansion of land transportation, China's coal transportation demand is gradually shifting from sea transportation to land transportation. This shift has had a direct impact on the bulk shipping market. According to the report, in 2023, the growth of coal transported by land will reduce the growth potential of global demand by 1% tonne-nautical miles.

From the loss of Australia, the expansion of Russia to the rise of Mongolia, the transformation of China's coal import model is not only the result of supply chain optimization, but also an extension of a geopolitical game. By diversifying its sources of imports, China not only reduces its dependence on a single supplier, but also takes a more flexible stance in dealing with uncertainties in the international energy market.

However, for the shipping industry, it is a complicated situation: traditional sea freight demand is being depressed, ton-nautical mile demand is declining, and emerging land transport modes are creating a race for infrastructure and logistics efficiency. In the future market development, the shipping industry needs to be alert to the long-term impact of this "overland" trend on the bulk shipping field, and seek new growth points.

While China's overall coal imports will jump 62 per cent to 473 million tonnes in 2023, seaborne imports will grow only 45 per cent, the report said. The data points to a sea change in global trade flows as China looks to diversify its supply away from traditional exporters and take advantage of geopolitical uncertainty to buy low-priced coal from other sources.

Australia's coal exports were once heavily dependent on the Chinese market. However, since 2019, Australia's share of China's coal import market has plummeted from 26 per cent to 11 per cent in 2023. The core reason behind this trend is the legacy effect of the Australian coal ban.

While Chinese imports of Australian thermal coal picked up after trade resumed in 2023, the picture for coking coal was bleak. In 2023, China imported just 2.8 million tonnes of Australian coking coal, a 91 per cent plunge from before the ban.

The report notes that Russia is a growing supplier of coal to China. In 2019, Russia's share of China's coal import market was only 11%, but by 2023 it had soared to 22%. This change is closely related to the war between Russia and Ukraine and the sanctions imposed on Russia by Western countries.

According to him, Russian coal exports to China increased by 34 million tons between 2022 and 2023, but only 18.7 million tons of this was transported by sea, which means 15.3 million tons were transported by land, further weakening the growth potential of the seaborne market.

Mongolia's rise to power

As an upstart in China's coal import market, Mongolia is breaking bottlenecks with its upgrading infrastructure. Mongolia exports about 90 per cent of its coal production, and its biggest buyer is China.

According to the Mongolian Coal Association, the country's coal production potential is as high as 100 million tons per year. However, this capability is limited by border infrastructure and customs procedures. In 2023, Mongolia took significant steps to increase its coal export capacity, including the opening of a new rail line linking its coal mines to the Chinese border.

The rise of overland supply chains is rapidly squeezing Australia's market share in coking coal and directly displacing the traditional maritime model.

Ton-nautical mile loss of seaborne coal

With the expansion of land transportation, China's coal transportation demand is gradually shifting from sea transportation to land transportation. This shift has had a direct impact on the bulk shipping market. According to the report, in 2023, the growth of coal transported by land will reduce the growth potential of global demand by 1% tonne-nautical miles.

From the loss of Australia, the expansion of Russia to the rise of Mongolia, the transformation of China's coal import model is not only the result of supply chain optimization, but also an extension of a geopolitical game. By diversifying its sources of imports, China not only reduces its dependence on a single supplier, but also takes a more flexible stance in dealing with uncertainties in the international energy market.

However, for the shipping industry, it is a complicated situation: traditional sea freight demand is being depressed, ton-nautical mile demand is declining, and emerging land transport modes are creating a race for infrastructure and logistics efficiency. In the future market development, the shipping industry needs to be alert to the long-term impact of this "overland" trend on the bulk shipping field, and seek new growth points.