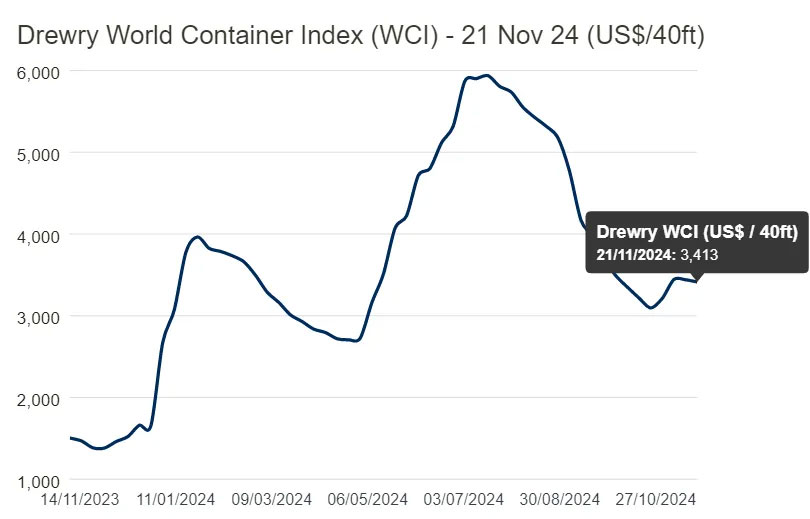

The freight index fell, and freight rates fell on almost all routes this week

According to the Shanghai Shipping Exchange, on November 22, the Shanghai export container comprehensive freight index was 2160.08 points, down 91.82 points from the previous period; China's export container freight index was 1467.91 points, an increase of 2% over the previous period.

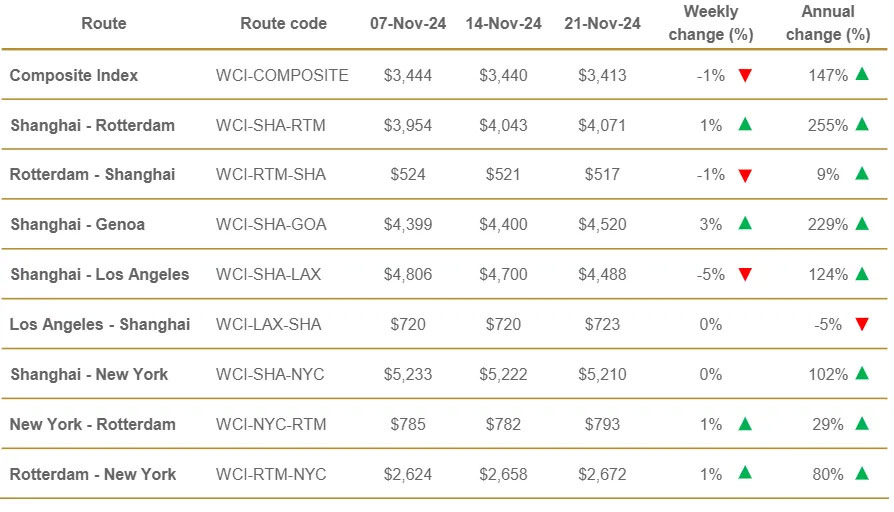

Among them, routes departing from China, compared to last week, Shanghai - Rotterdam rose 1% to $4,071 /FEU, Shanghai - Genoa rose 3% to about $4,520 /FEU, Shanghai - New York to $5,210 /FEU, and Shanghai - Los Angeles fell 5% to $4,488 /FEU. Mr Delury expects rates to remain stable next week.

Specific route rates are as follows:

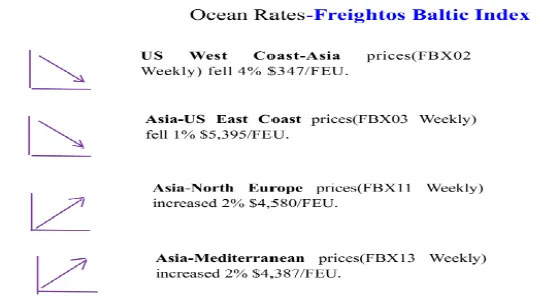

In addition to the slight increase in Asia to the Mediterranean and Northern Europe, Pacific routes from the US West Coast to Asia fell 4%, and Asia to the US East Coast fell 1%.

On the other hand, the shipments of the Double 11 e-commerce season have come to an end, and the market is now entering the traditional off-season. Next, it remains to be seen whether the market can usher in a wave of cargo peak from mid-December to the Spring Festival. At the same time, the progress of negotiations between dockworkers in the East of the United States on the automation of dock equipment, the tariff policy changes after Trump took office, and the factory shutdown time brought by the Lunar New Year earlier this year, these factors are likely to have an impact on the freight market.

The global shipping market is fraught with uncertainty in the face of Trump's tariff threat, the upcoming Lunar New Year rush and possible port strikes. As freight rates fluctuate and demand changes, the industry needs to pay close attention to market dynamics in order to flexibly adjust strategies to meet upcoming challenges and opportunities.

Among them, routes departing from China, compared to last week, Shanghai - Rotterdam rose 1% to $4,071 /FEU, Shanghai - Genoa rose 3% to about $4,520 /FEU, Shanghai - New York to $5,210 /FEU, and Shanghai - Los Angeles fell 5% to $4,488 /FEU. Mr Delury expects rates to remain stable next week.

Specific route rates are as follows:

In addition to the slight increase in Asia to the Mediterranean and Northern Europe, Pacific routes from the US West Coast to Asia fell 4%, and Asia to the US East Coast fell 1%.

On the other hand, the shipments of the Double 11 e-commerce season have come to an end, and the market is now entering the traditional off-season. Next, it remains to be seen whether the market can usher in a wave of cargo peak from mid-December to the Spring Festival. At the same time, the progress of negotiations between dockworkers in the East of the United States on the automation of dock equipment, the tariff policy changes after Trump took office, and the factory shutdown time brought by the Lunar New Year earlier this year, these factors are likely to have an impact on the freight market.

The global shipping market is fraught with uncertainty in the face of Trump's tariff threat, the upcoming Lunar New Year rush and possible port strikes. As freight rates fluctuate and demand changes, the industry needs to pay close attention to market dynamics in order to flexibly adjust strategies to meet upcoming challenges and opportunities.