Freight conditions in December: The freight economy is about to see a "directional" change

During FreightWaves' December State of Freight webinar, Craig Fuller, CEO of Freightwaves, and Zach Strickland, Director of Freight market Intelligence at SONAR, said the future of the freight market looks more certain than it has in years.

Last month, Zach Strickland and Craig Fuller said the Great Recession in the freight industry is over, and SONAR data shows that bid rejection rates and spot freight rates have been rising.

"When you start talking about directional changes... To declare that the freight recession is over, if the data does come from a reliable source, people will start to think about that, "Fuller said.

With the Great Recession in the freight industry lasting more than two and a half years, Strickland and Fuller said it will take some time for the market to return to pre-pandemic levels.

"Since the market bottomed last May, the market has been improving." Craig Fuller said. "I think the question now is still how fast is the market improving? Will this acceleration continue? Is there a risk next year? I think in general, most people would say that 2025 is definitely going to be better than 2024. The question is, how much better?"

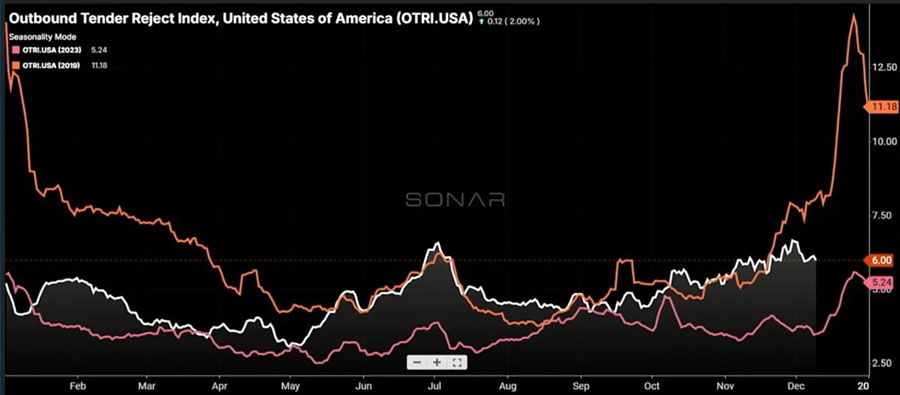

Strickland said SONAR's external bid rejection index is moving in the right direction.

Strickland said: "Our overseas bid rejection index shows us something new, the white line is that year. The orange line is 2019 and the dark red line is 2023. We have shown great improvement over the past period."

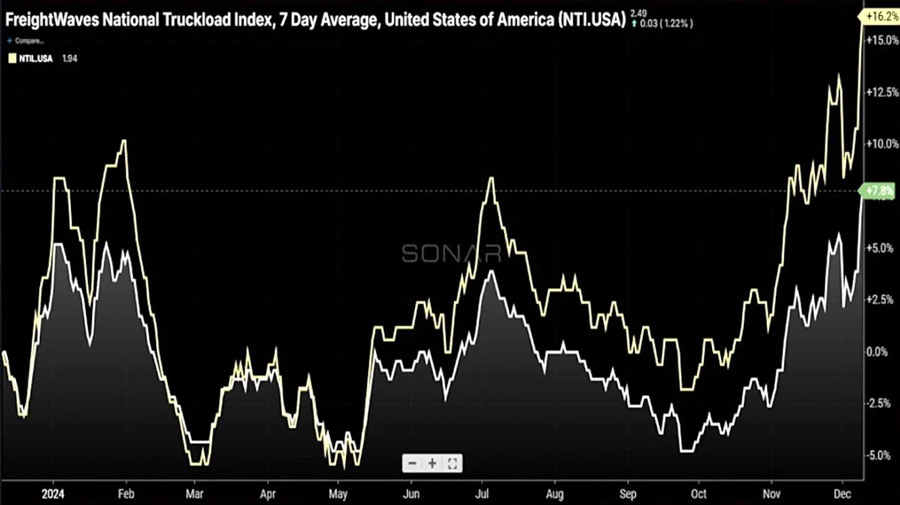

Data from SONAR's National Trucking Index (NTI.USA) shows spot freight rates at $2.49 per mile, up 16.2% year-over-year compared to the same period in 2023.

Strickland said that if NTI.USA is compared to SONAR's National Trucking Index (trunk line only), spot shipping prices for truckers are improving. NTIL measures the average spot shipping price for dry trucks traveling more than 250 miles, excluding the total estimated cost of fuel.

"I think the impact of fuel is the real point of this chart. The yellow part is [NTIL.USA] and does not include the total cost of fuel. If the average cost of diesel had not fallen 20 percent this year, this chart suggests that rates would actually be higher, "Strickland said.

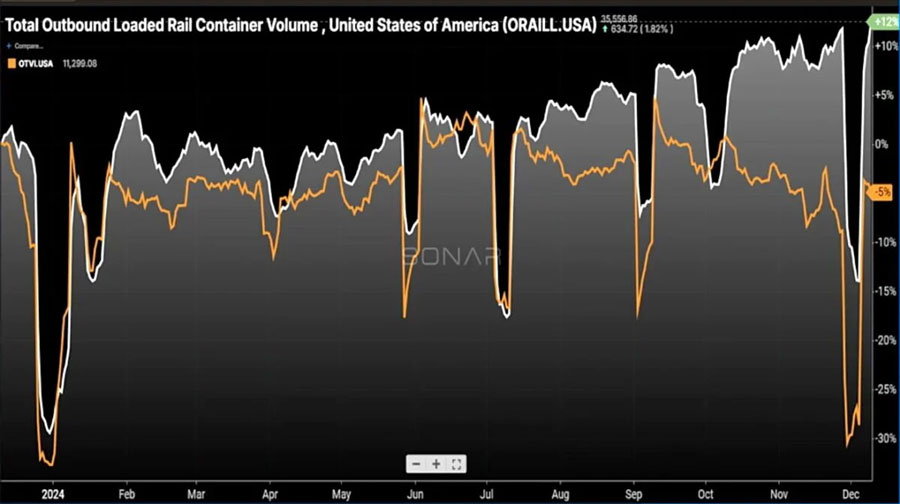

Strickland pointed out that at a time when multimodal traffic tends to slow down, international and domestic container long-distance rail traffic is increasing.

"This is not the season for an increase in intermodal container traffic," Strickland said.

Shippers who have ordered goods but are not in urgent need of inventory are using rail shipments similar to wheel warehouses, Fuller said.

"If I need retail merchandise, I don't put it on the rail in October because the rail does have delays." My goods need to be in my supply chain and distribution network by early October, but no later than mid-November. The reason for the push for intermodal transport is that these products are not needed now, so there is no need to put them in the warehouse. I think one of the values of using intermodal services is that it's slow, doesn't take up warehouse space, and there are tax benefits to doing so if you don't need the product right now. With imports at historically high levels relative to seasonality and those continuing to flow in as shippers prepare for tariff changes and other impacts, there is overall uncertainty. I think Donald Trump's policies are designed with some uncertainty. I think a lot of shippers are gearing up for that, and that's what we're seeing in the data, "Fuller said.

According to a press release from the National Association of Manufacturers, the U.S. manufacturing sector remained in contraction mode in November, but the pace of contraction was the lowest in the past five months.

"The manufacturing sector of the economy has been a bit sluggish. How do you feel about the downturn in manufacturing? Do you think manufacturing will recover next year?" Zach Strickland said.

Craig Fuller said major U.S. manufacturers continue to struggle, which is holding back economic growth.

"If you think about sectors in manufacturing that are struggling right now, like the aerospace industry, Boeing has major problems. If you look at the manufacturing data, you know how big the aerospace industry is in the United States, and one of the core principles of manufacturing is aerospace manufacturing. Boeing has had problems over the past few years, which have caused major problems. It's an important part of our export market, exporting aircraft. The car industry is also in trouble. There are reports that the chief executive of Stellantis has resigned. There have been reports that Nissan could file for bankruptcy, or at least have serious liquidity problems next year. The auto industry is struggling in large part because automakers are trying to capture as much of the Inflation-Reduction Act's incentives for electric vehicles as possible and build production and supply chains around them in what is expected to be a decades-long generational shift. The reality is that consumer demand hasn't caught up. All of that really bothers the auto market, people aren't buying cars, "Fuller said.

FreightWaves is launching a strategy manual for small fleet owners

Fuller said FreightWaves will launch its strategy for small fleet owners on Valentine's Day. The aim is to help small fleet owners grow their businesses by providing them with resources.

"We partnered with Adam Winfield and basically took his master-level approach and our content and curated form of SONAR data," Fuller said.

Wingfield is the founder and managing director of Innovative Logistics Group. The Charlotte, North Carolina-based company is a trucking consulting and carrier services company focused on providing resources and success coaching to smaller carriers.

"It's designed to help small fleet owners who are feeling their way. You can't be a broker and join, you can't be a shipper and join, you can't be a large broker and join, you have to be a small player. You must be a person with an MC number. We will create a community for small carriers and give them the resources to really manage their business. I'm very excited about this because nothing is more important than having a script for someone who runs a small carrier. The beauty of what we have at FreightWaves and what Adam has built is that we have all this tribal knowledge and data, we're looking at things, we see things, we know things, and frankly that knowledge makes it right for us to share that knowledge with the smallest players in the market, "he said. Craig Fuller said.

Last month, Zach Strickland and Craig Fuller said the Great Recession in the freight industry is over, and SONAR data shows that bid rejection rates and spot freight rates have been rising.

"When you start talking about directional changes... To declare that the freight recession is over, if the data does come from a reliable source, people will start to think about that, "Fuller said.

With the Great Recession in the freight industry lasting more than two and a half years, Strickland and Fuller said it will take some time for the market to return to pre-pandemic levels.

"Since the market bottomed last May, the market has been improving." Craig Fuller said. "I think the question now is still how fast is the market improving? Will this acceleration continue? Is there a risk next year? I think in general, most people would say that 2025 is definitely going to be better than 2024. The question is, how much better?"

Strickland said SONAR's external bid rejection index is moving in the right direction.

Strickland said: "Our overseas bid rejection index shows us something new, the white line is that year. The orange line is 2019 and the dark red line is 2023. We have shown great improvement over the past period."

Data from SONAR's National Trucking Index (NTI.USA) shows spot freight rates at $2.49 per mile, up 16.2% year-over-year compared to the same period in 2023.

Strickland said that if NTI.USA is compared to SONAR's National Trucking Index (trunk line only), spot shipping prices for truckers are improving. NTIL measures the average spot shipping price for dry trucks traveling more than 250 miles, excluding the total estimated cost of fuel.

"I think the impact of fuel is the real point of this chart. The yellow part is [NTIL.USA] and does not include the total cost of fuel. If the average cost of diesel had not fallen 20 percent this year, this chart suggests that rates would actually be higher, "Strickland said.

Strickland pointed out that at a time when multimodal traffic tends to slow down, international and domestic container long-distance rail traffic is increasing.

"This is not the season for an increase in intermodal container traffic," Strickland said.

Shippers who have ordered goods but are not in urgent need of inventory are using rail shipments similar to wheel warehouses, Fuller said.

"If I need retail merchandise, I don't put it on the rail in October because the rail does have delays." My goods need to be in my supply chain and distribution network by early October, but no later than mid-November. The reason for the push for intermodal transport is that these products are not needed now, so there is no need to put them in the warehouse. I think one of the values of using intermodal services is that it's slow, doesn't take up warehouse space, and there are tax benefits to doing so if you don't need the product right now. With imports at historically high levels relative to seasonality and those continuing to flow in as shippers prepare for tariff changes and other impacts, there is overall uncertainty. I think Donald Trump's policies are designed with some uncertainty. I think a lot of shippers are gearing up for that, and that's what we're seeing in the data, "Fuller said.

According to a press release from the National Association of Manufacturers, the U.S. manufacturing sector remained in contraction mode in November, but the pace of contraction was the lowest in the past five months.

"The manufacturing sector of the economy has been a bit sluggish. How do you feel about the downturn in manufacturing? Do you think manufacturing will recover next year?" Zach Strickland said.

Craig Fuller said major U.S. manufacturers continue to struggle, which is holding back economic growth.

"If you think about sectors in manufacturing that are struggling right now, like the aerospace industry, Boeing has major problems. If you look at the manufacturing data, you know how big the aerospace industry is in the United States, and one of the core principles of manufacturing is aerospace manufacturing. Boeing has had problems over the past few years, which have caused major problems. It's an important part of our export market, exporting aircraft. The car industry is also in trouble. There are reports that the chief executive of Stellantis has resigned. There have been reports that Nissan could file for bankruptcy, or at least have serious liquidity problems next year. The auto industry is struggling in large part because automakers are trying to capture as much of the Inflation-Reduction Act's incentives for electric vehicles as possible and build production and supply chains around them in what is expected to be a decades-long generational shift. The reality is that consumer demand hasn't caught up. All of that really bothers the auto market, people aren't buying cars, "Fuller said.

FreightWaves is launching a strategy manual for small fleet owners

Fuller said FreightWaves will launch its strategy for small fleet owners on Valentine's Day. The aim is to help small fleet owners grow their businesses by providing them with resources.

"We partnered with Adam Winfield and basically took his master-level approach and our content and curated form of SONAR data," Fuller said.

Wingfield is the founder and managing director of Innovative Logistics Group. The Charlotte, North Carolina-based company is a trucking consulting and carrier services company focused on providing resources and success coaching to smaller carriers.

"It's designed to help small fleet owners who are feeling their way. You can't be a broker and join, you can't be a shipper and join, you can't be a large broker and join, you have to be a small player. You must be a person with an MC number. We will create a community for small carriers and give them the resources to really manage their business. I'm very excited about this because nothing is more important than having a script for someone who runs a small carrier. The beauty of what we have at FreightWaves and what Adam has built is that we have all this tribal knowledge and data, we're looking at things, we see things, we know things, and frankly that knowledge makes it right for us to share that knowledge with the smallest players in the market, "he said. Craig Fuller said.