The truce of the trade war has driven up freight rates due to the rush to transport goods

Amid a cautious and wait-and-see attitude in the global shipping market, the "temporary truce" of the Sino-US trade war has quickly ignited the enthusiasm of the Trans-Pacific container market. Spot freight rates have soared sharply, and booking volumes have skyrocketed in a short period of time. In response, shipping companies have significantly adjusted their capacity deployments, and some originally postponed route plans have also been urgently initiated.

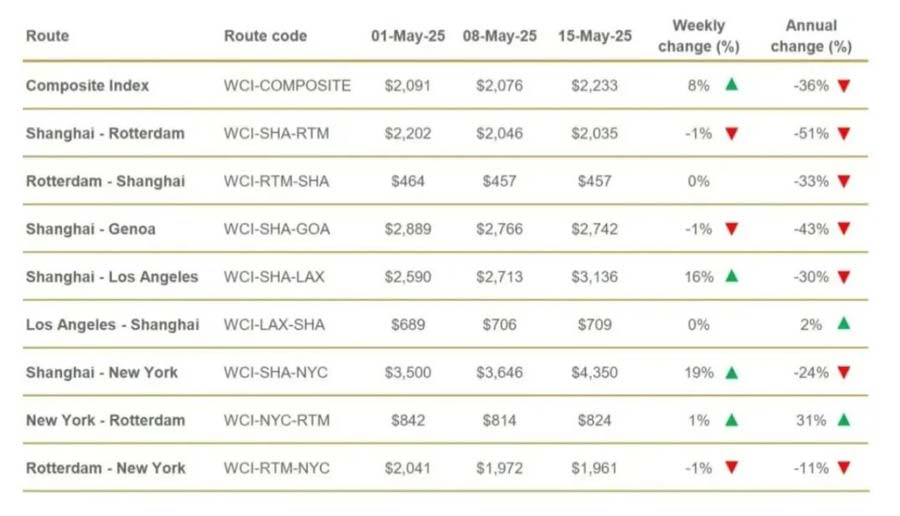

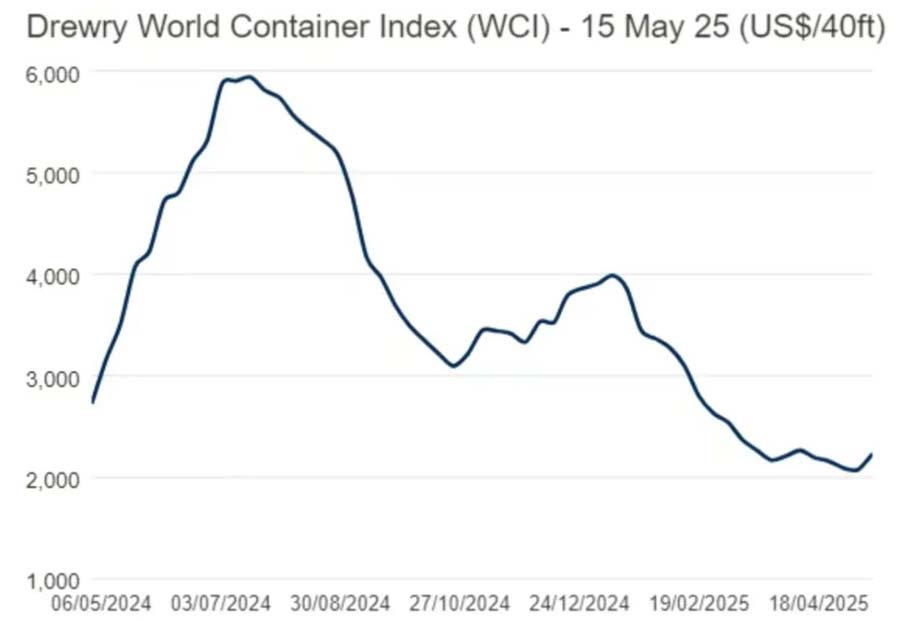

According to Drewry's latest World Container Index (WCI), in the week ending May 15, Shanghai-New York rose 19% to $4,350 /FEU, and Shanghai-Los Angeles increased 16% to $3,136 /FEU.

This wave of demand not only stems from the market's strong response to the "90-day tariff buffer period", but also is superimposed by the earlier announced general increase in surcharges (GRI) by several shipping companies. Since May 15th, the market has generally implemented GRI at $1,000 to $3,000 per box, and all have been successfully "landed". More importantly, the second round of GRI, which is set to kick off on June 1st, is also likely to be solidified due to demand support.

The Shanghai Containerized Freight Index (SCFI) also confirms this trend: This week, the spot prices on the Shanghai to the West Coast Port of the United States rose by 31% compared with the previous week, while those on the East Coast Port of the United States increased by 22%. The rapid increase in prices caught the market off guard.

Maersk said, "Customers currently have a 90-day certainty window, and we are also actively assisting them in completing the maximum shipment within this period." The company disclosed that the capacity that was once reduced in April is now being restored at an accelerated pace, not only by replacing large vessels but also by enhancing the overall turnover efficiency.

Premier Alliance announced that the PS5 route, which was originally planned to be postponed, is about to go live and will be led and operated by ONE. The maiden voyage was set off from Qingdao on June 5th by the "YM Mobility" (6,500 TEU), calling at ports including Qingdao, Ningbo, Changtan, Auckland and Kobe. It is planned to deploy a total of 7 vessels for rotational operation.

Meanwhile, other major shipping companies such as CMA CGM and MSC are also adjusting their capacity internally. Some feeder routes have been temporarily compressed or integrated to make way for the main Trans-Pacific routes.

It is worth noting that this round of price hikes is not a steady increase but rather closer to a "peak rebound". While the demand is expanding rapidly, the price elasticity is also magnified infinitely. Some customers are wavering between waiting and seeing and snapping up space, which has exacerbated market volatility in the short term.

The current market quotations are highly differentiated. The quotations from freight forwarders can vary by more than $1,000 per container, depending on multiple variables such as shipping routes, loading ports, and container loading times. Some high-value and urgent cargo orders are even willing to pay temporary surcharges to secure shipping space.

In this market situation, shipping companies that control cabin resources and large NVOCCs (non-vessel Operating Common Carriers) hold the absolute initiative. However, based on past experience, such explosive market trends often lack sustained support. Once market expectations change and policy variables rise again, prices may also experience a significant pullback in a short period of time.

The brief ceasefire of the Sino-US trade war has brought a glimmer of "breathing space" to the market, but this is not a fundamental turning point. Fundamentally speaking, the current Trans-Pacific boom is still based on policy expectations and demand panic rather than a comprehensive recovery in actual consumption.

It is widely believed in the industry that if no long-term purchasing replenishment or inventory rebuilding can be seen within the 90-day window period, this round of market trend may peak and fall back in late June or early July. In addition, markets in other regions such as the Middle East, Latin America, and Southeast Asia have not witnessed a synchronous strong rebound, and the shipping market is still in a stage of structural recovery.

For shipping companies, the biggest challenge lies in: how to act decisively when freight rates soar in the short term and then contract promptly when the market reverses to avoid missing out? For shippers and freight forwarders, it is necessary to seek stable cooperative resources amid uncertainties and enhance the adaptability of the supply chain.

According to Drewry's latest World Container Index (WCI), in the week ending May 15, Shanghai-New York rose 19% to $4,350 /FEU, and Shanghai-Los Angeles increased 16% to $3,136 /FEU.

This wave of demand not only stems from the market's strong response to the "90-day tariff buffer period", but also is superimposed by the earlier announced general increase in surcharges (GRI) by several shipping companies. Since May 15th, the market has generally implemented GRI at $1,000 to $3,000 per box, and all have been successfully "landed". More importantly, the second round of GRI, which is set to kick off on June 1st, is also likely to be solidified due to demand support.

The Shanghai Containerized Freight Index (SCFI) also confirms this trend: This week, the spot prices on the Shanghai to the West Coast Port of the United States rose by 31% compared with the previous week, while those on the East Coast Port of the United States increased by 22%. The rapid increase in prices caught the market off guard.

Maersk said, "Customers currently have a 90-day certainty window, and we are also actively assisting them in completing the maximum shipment within this period." The company disclosed that the capacity that was once reduced in April is now being restored at an accelerated pace, not only by replacing large vessels but also by enhancing the overall turnover efficiency.

Premier Alliance announced that the PS5 route, which was originally planned to be postponed, is about to go live and will be led and operated by ONE. The maiden voyage was set off from Qingdao on June 5th by the "YM Mobility" (6,500 TEU), calling at ports including Qingdao, Ningbo, Changtan, Auckland and Kobe. It is planned to deploy a total of 7 vessels for rotational operation.

Meanwhile, other major shipping companies such as CMA CGM and MSC are also adjusting their capacity internally. Some feeder routes have been temporarily compressed or integrated to make way for the main Trans-Pacific routes.

It is worth noting that this round of price hikes is not a steady increase but rather closer to a "peak rebound". While the demand is expanding rapidly, the price elasticity is also magnified infinitely. Some customers are wavering between waiting and seeing and snapping up space, which has exacerbated market volatility in the short term.

The current market quotations are highly differentiated. The quotations from freight forwarders can vary by more than $1,000 per container, depending on multiple variables such as shipping routes, loading ports, and container loading times. Some high-value and urgent cargo orders are even willing to pay temporary surcharges to secure shipping space.

In this market situation, shipping companies that control cabin resources and large NVOCCs (non-vessel Operating Common Carriers) hold the absolute initiative. However, based on past experience, such explosive market trends often lack sustained support. Once market expectations change and policy variables rise again, prices may also experience a significant pullback in a short period of time.

The brief ceasefire of the Sino-US trade war has brought a glimmer of "breathing space" to the market, but this is not a fundamental turning point. Fundamentally speaking, the current Trans-Pacific boom is still based on policy expectations and demand panic rather than a comprehensive recovery in actual consumption.

It is widely believed in the industry that if no long-term purchasing replenishment or inventory rebuilding can be seen within the 90-day window period, this round of market trend may peak and fall back in late June or early July. In addition, markets in other regions such as the Middle East, Latin America, and Southeast Asia have not witnessed a synchronous strong rebound, and the shipping market is still in a stage of structural recovery.

For shipping companies, the biggest challenge lies in: how to act decisively when freight rates soar in the short term and then contract promptly when the market reverses to avoid missing out? For shippers and freight forwarders, it is necessary to seek stable cooperative resources amid uncertainties and enhance the adaptability of the supply chain.