Peak season freight rates fell sharply, shipping companies bid up freight era ended

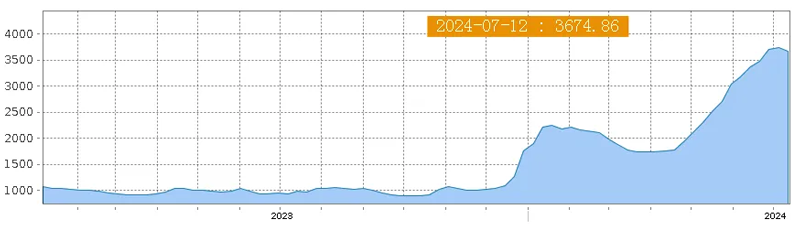

The SCFI container freight index released by the Shanghai Shipping Exchange on Friday fell to 3,675 points, down 1.57 per cent from the previous week, ending a 13-week rise. Some analysis reports pointed out that the decline in freight rates in July to August, the most seasonal period, highlights the problem of excess ship capacity; Non-maritime alliance airlines have joined the competition of the US-West route, and its market share has surged from 15% to 30% in the past nine months, indicating that the original strategy of airlines to increase freight rates through alliance will face the risk of losing control, and may repeat the trend of sharp decline in freight rates in the peak season of 2022.

The analysis further pointed out that if the peak season is not able to support freight rates, then the situation will be more severe after entering the off-season. In response to this challenge, shipping alliance operators need to increase efforts to idle ships to control capacity supply, otherwise under the combination of multiple adverse factors, freight rates may be hit hard again, repeating the mistakes of the 2022 peak season.

(1) Significant reduction in congestion at the Port of Singapore: With the opening of new berths, waiting times for ships at the Port of Singapore have been reduced significantly, from long waits of more than a week in late May to less than two days during the current peak season. This change has effectively eased congestion at the port.

(2) The water level of the Panama Canal has risen, and the capacity of the Panama Canal has been greatly improved: After experiencing a period of downturn in the capacity of the Panama Canal, with the arrival of the rainy season and the recovery of the water level of the lake, the number of ships that can pass each day has increased rapidly. Starting with a record low of 18 vessels on March 15, 2024, the Panama Canal gradually eased its passage restrictions to 24 vessels on May 16; Expanded to 32 ships on June 1; Expanded to 33 ships on 11 July; Expanded to 34 on 22 July; On August 5, it was increased to 35 ships per day, showing a significant improvement in its transport efficiency.

(3) The influx of non-maritime alliance vessels into the market: The maritime alliance originally raised freight rates through group cooperation, but this strategy is facing challenges. Danish maritime data analysis company Sea-Intelligence report pointed out that with the rise in shipping prices, attract a large number of non-shipping alliance shipping operators, invest a large number of ships, competing for supplies. In particular, on the US-West route, the share of non-alliance capacity has climbed rapidly from a low of 15% in October 2023 to 30% today, a change that has had a significant impact on the ability of alliance carriers to control freight rates.

(4) The surge in new ship deliveries and order backlog indicate a long-term oversupply: the global container fleet capacity continues to grow, reaching 30.21 million TEUs on July 10, 2024. The past year has seen record new ship deliveries, particularly in the full year of 2023 (2.3 million boxes delivered) and the first five months of 2024 (1.37 million boxes delivered). In addition, as of June 8, 2024, the global backlog of new container ship orders reached 5.75 million TEUs, equivalent to 3.4 Evergreen capacity, accounting for 19% of the current global container fleet capacity, indicating that excess capacity will be a long-term trend facing the future market.

The analysis further pointed out that if the peak season is not able to support freight rates, then the situation will be more severe after entering the off-season. In response to this challenge, shipping alliance operators need to increase efforts to idle ships to control capacity supply, otherwise under the combination of multiple adverse factors, freight rates may be hit hard again, repeating the mistakes of the 2022 peak season.

(1) Significant reduction in congestion at the Port of Singapore: With the opening of new berths, waiting times for ships at the Port of Singapore have been reduced significantly, from long waits of more than a week in late May to less than two days during the current peak season. This change has effectively eased congestion at the port.

(2) The water level of the Panama Canal has risen, and the capacity of the Panama Canal has been greatly improved: After experiencing a period of downturn in the capacity of the Panama Canal, with the arrival of the rainy season and the recovery of the water level of the lake, the number of ships that can pass each day has increased rapidly. Starting with a record low of 18 vessels on March 15, 2024, the Panama Canal gradually eased its passage restrictions to 24 vessels on May 16; Expanded to 32 ships on June 1; Expanded to 33 ships on 11 July; Expanded to 34 on 22 July; On August 5, it was increased to 35 ships per day, showing a significant improvement in its transport efficiency.

(3) The influx of non-maritime alliance vessels into the market: The maritime alliance originally raised freight rates through group cooperation, but this strategy is facing challenges. Danish maritime data analysis company Sea-Intelligence report pointed out that with the rise in shipping prices, attract a large number of non-shipping alliance shipping operators, invest a large number of ships, competing for supplies. In particular, on the US-West route, the share of non-alliance capacity has climbed rapidly from a low of 15% in October 2023 to 30% today, a change that has had a significant impact on the ability of alliance carriers to control freight rates.

(4) The surge in new ship deliveries and order backlog indicate a long-term oversupply: the global container fleet capacity continues to grow, reaching 30.21 million TEUs on July 10, 2024. The past year has seen record new ship deliveries, particularly in the full year of 2023 (2.3 million boxes delivered) and the first five months of 2024 (1.37 million boxes delivered). In addition, as of June 8, 2024, the global backlog of new container ship orders reached 5.75 million TEUs, equivalent to 3.4 Evergreen capacity, accounting for 19% of the current global container fleet capacity, indicating that excess capacity will be a long-term trend facing the future market.