2M to part ways? Maersk could slip into third place

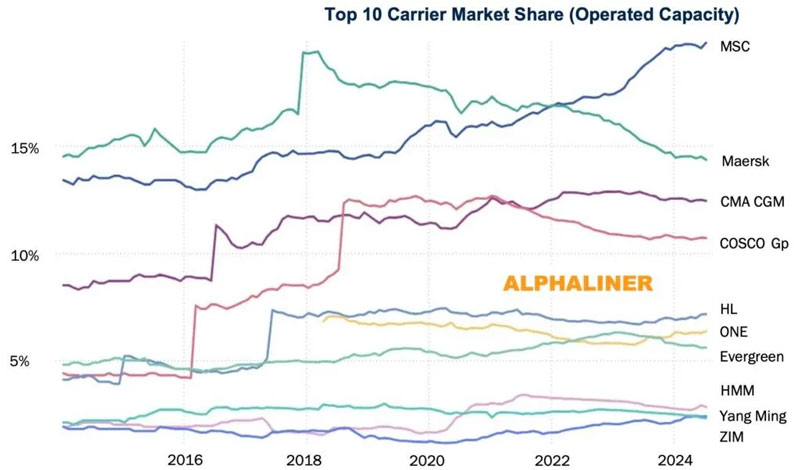

Mediterranean Shipping (MSC) and Maersk Line are adopting different development strategies, MSC plans to operate independently and expand the fleet, which is expected to exceed 7 million TEU by 2026; Maersk insists on the upper limit of fleet size, focuses on logistics integration, and will order environmentally friendly new ships, but faces financial and market ranking pressure, or fall to third place in the world.

Two of the world's largest container shipping companies, MSC and Maersk Line, are planning very different paths and preparing to part ways from next year.

MSC, with a fleet of more than 6 million equivalent units (TEUs), accounts for about 20% of the global container fleet, demonstrating a strong market position.

Maersk Line reiterated on the 7th that it will stick to its fleet size cap policy until the end of the century and adopt a logistics integrator strategy from 2018, focusing on broad investments in the logistics sector rather than simply expanding its container shipping business. The company's new chief executive, Vincent Ko, has stressed that its future focus will be on organic growth and value-added acquisitions in the logistics sector.

However, Maersk's interim results showed that its operating margin lagged behind its peers, with EBIT falling sharply to $1.1 billion and margins falling to 4.5 percent year-on-year. Analysts Alphaliner warned that Maersk could face pressure from shareholders to change its strategy without a significant improvement in its financial performance.

Maersk also announced a new build ship policy to 2030, clarifying that the fleet size will remain within the current 4.3 million TEU, and announced that it will order dual-fuel vessels using bio-liquefied natural gas (including methanol and liquefied biomethanes), marking a shift in its fuel selection strategy. These new vessels will replace older vessels at a rate of approximately 160,000TEU per year to maintain a stable fleet size.

Analysts at Alphaliner predict that with the launch of the Gemini Alliance early next year, MSC will have a market share equal to that of Maersk and Hapag-Lloyd combined.

In addition, MSC is actively seeking cooperation with Chinese shipyards to expand its new ship construction program, potentially adding another 300,000 TEU to its existing order book.

Two of the world's largest container shipping companies, MSC and Maersk Line, are planning very different paths and preparing to part ways from next year.

MSC, with a fleet of more than 6 million equivalent units (TEUs), accounts for about 20% of the global container fleet, demonstrating a strong market position.

Maersk Line reiterated on the 7th that it will stick to its fleet size cap policy until the end of the century and adopt a logistics integrator strategy from 2018, focusing on broad investments in the logistics sector rather than simply expanding its container shipping business. The company's new chief executive, Vincent Ko, has stressed that its future focus will be on organic growth and value-added acquisitions in the logistics sector.

However, Maersk's interim results showed that its operating margin lagged behind its peers, with EBIT falling sharply to $1.1 billion and margins falling to 4.5 percent year-on-year. Analysts Alphaliner warned that Maersk could face pressure from shareholders to change its strategy without a significant improvement in its financial performance.

Maersk also announced a new build ship policy to 2030, clarifying that the fleet size will remain within the current 4.3 million TEU, and announced that it will order dual-fuel vessels using bio-liquefied natural gas (including methanol and liquefied biomethanes), marking a shift in its fuel selection strategy. These new vessels will replace older vessels at a rate of approximately 160,000TEU per year to maintain a stable fleet size.

Analysts at Alphaliner predict that with the launch of the Gemini Alliance early next year, MSC will have a market share equal to that of Maersk and Hapag-Lloyd combined.

In addition, MSC is actively seeking cooperation with Chinese shipyards to expand its new ship construction program, potentially adding another 300,000 TEU to its existing order book.