With an increase of 3.75%, Xiamen Port released its semi-annual report for 2024

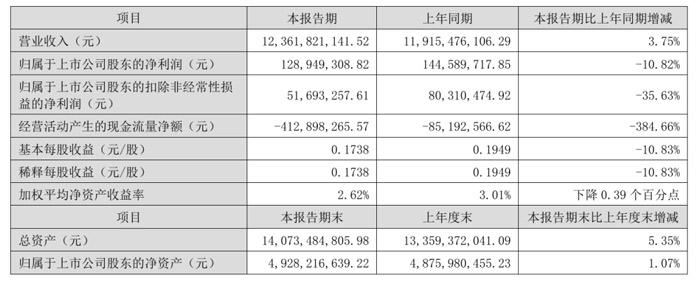

On the evening of August 28, Xiamen Port Development Co., LTD. (hereinafter referred to as "Xiamen Port", 000905) released its 2024 semi-annual report. During the reporting period, Xiamen Port achieved an operating income of 12.362 billion yuan, an increase of 3.75%; The total profit was 246 million yuan, an increase of 2.26%, and the net profit returned to the mother was 129 million yuan, a decrease of 10.82%; Basic earnings per share of 0.1738 yuan, down 10.83%; The weighted average return on equity was 2.62%, down 0.39 percentage points.

During the reporting period, Xiamen Port achieved a cargo throughput of 19.0541 million tons, a year-on-year decrease of 12.64%, mainly due to the reduction in the loading and unloading demand of iron ore in Xiamen Port and sand in domestic trade mechanism outside Xiamen Port. Among them: the cargo throughput of Xiamen port completed 15.329,800 tons, basically unchanged from the same period last year, the demand for bulk and general cargo handling in Xiamen Port was relatively stable, and the growth of coal, grain and other cargo was good.

Xiamen Port has scarce bulk and general cargo terminal resources and industry barriers. The total length of the terminal shoreline is about 5.8 kilometers. Currently, there are 18 production berths in operation (including leased and managed berths) and 3 berths under construction. The terminal land area is about 2.52 million square meters (of which 2.06 million square meters are owned and 460,000 square meters are managed). Grain silos have a maximum stock of about 220,000 tons, covering four regions of Xiamen, Quanzhou, Zhangzhou and Chaozhou, basically realizing the network layout and large-scale operation of bulk and general cargo terminals. It has the largest class of bulk cargo berths in Xiamen Port, which can berthing 200,000-ton bulk carriers. Its wharf is the only large-scale coal and iron ore public wharf in Xiamen Port and the largest in Xiamen Port, and has special railway lines in Dongdu and Haicang port areas, radiating Jiangxi and East Guangdong through the port railway and connecting all parts of the country.

Xiamen Port said that at present, China's coastal port layout has formed five port groups, and Xiamen Port is in the southeast coastal port group. There are many bulk and general cargo terminals in Xiamen port, and the market competition is relatively full. Xiamen Port competes with other ports in grain, stone and other cargo types. Meanwhile, Xiamen Port faces competition from ports in the Yangtze River Delta, Pearl River Delta and the east coast of the Strait. Compared with the Yangtze River Delta and Pearl River Delta port groups, the economic development of Xiamen Port hinterland needs to be improved, and the cargo market is relatively limited. Because the economic hinterland served by the port groups has a certain intersection, the competition among the port groups is becoming increasingly obvious, and the competition for the hinterland cargo is becoming increasingly fierce. Moreover, as an important infrastructure, bulk and general cargo terminals have large investment, long payback period and greater pressure in the early stage of operation. In the port logistics business, customs declaration, freight forwarding, air transportation and other businesses are fully competitive, profit margins are limited, and trailer transportation, storage yards and other businesses are under great pressure, requiring further transformation and upgrading. In terms of port trade, changes in the international economic situation may lead to large fluctuations in commodity prices, which in turn will have a certain impact on customer demand, product prices, stocking costs, etc., of port trade business, and may even lead to risk events.

During the reporting period, Xiamen Port achieved a cargo throughput of 19.0541 million tons, a year-on-year decrease of 12.64%, mainly due to the reduction in the loading and unloading demand of iron ore in Xiamen Port and sand in domestic trade mechanism outside Xiamen Port. Among them: the cargo throughput of Xiamen port completed 15.329,800 tons, basically unchanged from the same period last year, the demand for bulk and general cargo handling in Xiamen Port was relatively stable, and the growth of coal, grain and other cargo was good.

Xiamen Port has scarce bulk and general cargo terminal resources and industry barriers. The total length of the terminal shoreline is about 5.8 kilometers. Currently, there are 18 production berths in operation (including leased and managed berths) and 3 berths under construction. The terminal land area is about 2.52 million square meters (of which 2.06 million square meters are owned and 460,000 square meters are managed). Grain silos have a maximum stock of about 220,000 tons, covering four regions of Xiamen, Quanzhou, Zhangzhou and Chaozhou, basically realizing the network layout and large-scale operation of bulk and general cargo terminals. It has the largest class of bulk cargo berths in Xiamen Port, which can berthing 200,000-ton bulk carriers. Its wharf is the only large-scale coal and iron ore public wharf in Xiamen Port and the largest in Xiamen Port, and has special railway lines in Dongdu and Haicang port areas, radiating Jiangxi and East Guangdong through the port railway and connecting all parts of the country.

Xiamen Port said that at present, China's coastal port layout has formed five port groups, and Xiamen Port is in the southeast coastal port group. There are many bulk and general cargo terminals in Xiamen port, and the market competition is relatively full. Xiamen Port competes with other ports in grain, stone and other cargo types. Meanwhile, Xiamen Port faces competition from ports in the Yangtze River Delta, Pearl River Delta and the east coast of the Strait. Compared with the Yangtze River Delta and Pearl River Delta port groups, the economic development of Xiamen Port hinterland needs to be improved, and the cargo market is relatively limited. Because the economic hinterland served by the port groups has a certain intersection, the competition among the port groups is becoming increasingly obvious, and the competition for the hinterland cargo is becoming increasingly fierce. Moreover, as an important infrastructure, bulk and general cargo terminals have large investment, long payback period and greater pressure in the early stage of operation. In the port logistics business, customs declaration, freight forwarding, air transportation and other businesses are fully competitive, profit margins are limited, and trailer transportation, storage yards and other businesses are under great pressure, requiring further transformation and upgrading. In terms of port trade, changes in the international economic situation may lead to large fluctuations in commodity prices, which in turn will have a certain impact on customer demand, product prices, stocking costs, etc., of port trade business, and may even lead to risk events.