Freight rates fell for the fifth consecutive week, and more than 100 voyages were cancelled in the next five weeks

Shanghai Shipping Exchange 20 announced the latest SCFI index fell 5.76%, the index has fallen for the fifth consecutive week, the decline has been convergence, but the four major routes are still showing a downward trend, especially Europe and the Mediterranean route decline is more significant. Over 100 sailings cancelled in the next 5 weeks.

The latest Shanghai export container Freight Index (SCFI) released on the 20th showed that the index continued to fall 144.71 points this week to 2366.24 points, a decline of 5.76%, compared with the 7.91% decline last week. The World Container Freight Index (WCI) released by Delury on Thursday also showed a 5% decline in the composite index this week, also less than last week's 13% decline.

Specifically, the decline in SCFI was mainly concentrated on the European and Mediterranean routes, with the largest decline. Among them, the freight rate from the Far East to the Mediterranean has fallen below the $3,000 mark, and the route has plunged 12.18%, becoming the most significant decline among the four major routes. In addition, the European route fell by 8.76%, while the US-East route fell by 5.15%. In contrast, the US-West route saw a smaller decline of 2.78 per cent.

Specifically, the market focus is on the impasse in the labor negotiations between the United States East and Mexico Bay Terminal, and the labor side plans to launch a general strike on October 1, which further aggravates the market uncertainty. In the face of this situation, shipping companies and shippers have taken countermeasures, some shippers choose to divert the United States East cargo to the United States West, while some choose to suspend shipments to see how the situation develops. These measures have eased the downward pressure on freight rates on the West line to some extent, but the freight rate on the East line per 40 feet container has fallen sharply by more than $1,000 in two weeks.

In response to the potential strike risk, a number of shipping companies have announced plans to impose surcharges on the United States East and Mexico Bay routes, such as CMA CGM ships will charge a "port surcharge" (LPC) from October 11, $1,500 per 20-foot container and $3,000 per 40-foot container. Hapag-lloyd is set to impose an "interruption surcharge" (WDS) of $1,000 per 20-foot container starting Oct. 18 to cover possible increased operating costs.

Despite the continued decline in freight rates, Evergreen Shipping remains optimistic about the freight market in the fourth quarter and next year. The ongoing impact of the Red Sea crisis, shipping delays at ports in North America and Asia, and the early Lunar New Year in 2025 will combine to maintain the stability of cargo volumes and drive a stable correction in freight rates.

People in the logistics industry pointed out that the current freight rate does not truly reflect the market situation, with the clear risk of strike at the East terminal and the increase in shipping demand after the 11th holiday, it is expected that there will be a new pattern of changes in freight rates from October.

In addition, this year's labor negotiations on the East Coast of the United States pose significant challenges to the shipping industry, and coupled with the complex situation in the United States in an election year, shipping companies and logistics operators need to remain on high alert and closely monitor the progress of negotiations. For European routes, the Red Sea crisis may cause ships to sail around the Cape of Good Hope in South Africa to become the norm, which will increase the operating costs of shipping companies. The market predicts that with the consideration of cost effectiveness, some small ships may withdraw from the market due to the inability to adapt to market changes, which will help promote the healthy development of the shipping market.

SCFI index

Shanghai to Europe line freight 2,592 US dollars /TEU, down 249 US dollars, down 8.76%;

Shanghai to Mediterranean freight 2,955 USD /TEU, down 410 USD or 12.18%;

Shanghai to the United States West freight 5341 US dollars /FEU, week down 153 US dollars, down 2.78%;

Shanghai to the United States East freight 6486 US dollars /FEU, down 352 US dollars, a decline of 5.15%.

Persian Gulf route freight of $1,147, down $117, or 9.26%;

South American route (Santos) freight of $6,990, down $311, or 4.26%.

Southeast Asia Line (Singapore) freight 412 US dollars, down 35 US dollars, or 7.83%.

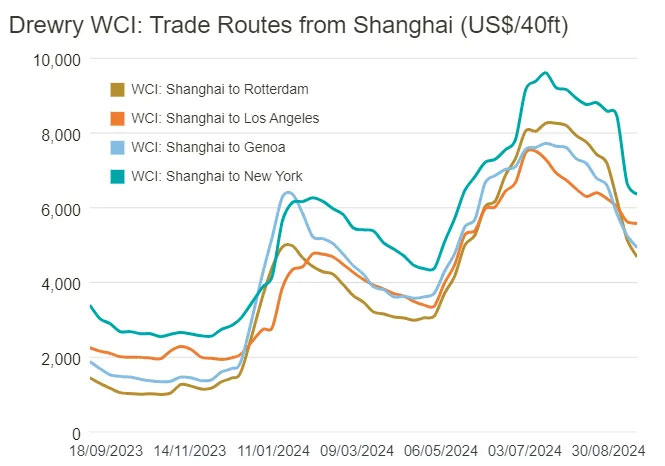

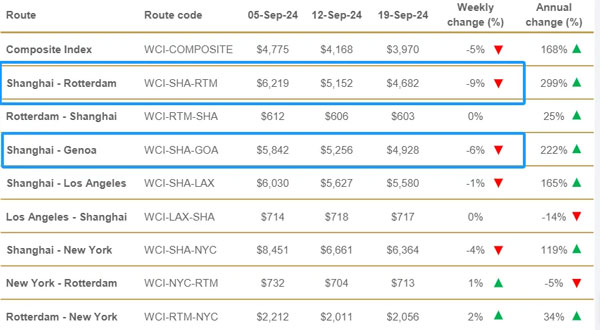

WCI index

WCI fell 5% this week to $3,970 per large box (40-foot container), 62% below the September 2021 peak of $10,377 during the pandemic, but still 180% above the pre-pandemic 2019 average rate of $1,420.

The year-to-date average composite index is $4,124 per large box, $1,302 higher than the 10-year average rate of $2,821. Freight rates from Shanghai to Rotterdam plunged 9 percent this week, or $470 per large box, to $4,682. Freight from Shanghai to Genoa fell 6 percent, or $328, to $4,928. Similarly, prices from Shanghai to New York dropped 4 percent, or $297 to $6,364 per large case. In addition, the spot freight rate from Shanghai to Los Angeles dropped 1%, down 47 dollars to 5,580 dollars.

While the looming American East International Longshoremen's Association (ILA) port strike cast a shadow, trans-Pacific eastbound freight rates fell slightly this week. Delury expects weak demand to drive rates down further in the eastern and western spot markets in the coming weeks.

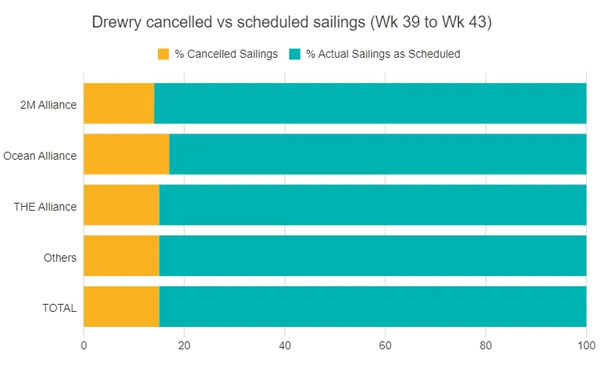

According to Delury's latest cancellation tracking data, during the 39th week (September 23 to September 29) and 43rd week (October 21 to October 27), out of 693 scheduled sailings on major trans-Pacific, trans-Atlantic and Asian east-west routes to Northern Europe and the Mediterranean, shipping lines announced a total of 105 cancellations. The cancellation rate is 15%. During this period, 64 percent of empty voyages will be on trans-Pacific eastbound routes, 24 percent on Asia-Nordic and Mediterranean routes, and 12 percent on trans-Atlantic westbound routes.

'The reliability of shipping schedules is declining,' Mr. Delury said. An average of 85% of ships are expected to depart on schedule in the next five weeks.

Freight rates on key East-West trade routes continue to fall due to sluggish demand. On Sept. 19, Delury's WCI Composite Index fell 5% week over week to $3,970 per 40-foot container. Trans-pacific freight rates fell 8%, Asia-Nordic/Mediterranean freight rates fell 3%, while trans-Atlantic freight rates rose 2%.

The East Coast of the US is facing a possible strike within two weeks as negotiations stall and unions refuse to accept government arbitration. Alternative terminals on the West coast of Canada and the United States may struggle to handle diverted East Coast cargoes, and some shippers have moved ahead to divert cargoes to avoid disruption.

In light of this, Delury reminds shippers and Beneficial Cargo Owners (BCOs) to be vigilant against possible increases in the cost of shipping goods to the East Coast of the United States, the Gulf Coast, the Caribbean, Mexico and Canada. In fact, several carriers have announced that emergency operating surcharges will be implemented from next month in response to the upcoming challenges, which will directly drive up the related transport costs. Therefore, all parties need to plan and prepare in advance to deal with possible market changes.

The latest Shanghai export container Freight Index (SCFI) released on the 20th showed that the index continued to fall 144.71 points this week to 2366.24 points, a decline of 5.76%, compared with the 7.91% decline last week. The World Container Freight Index (WCI) released by Delury on Thursday also showed a 5% decline in the composite index this week, also less than last week's 13% decline.

Specifically, the decline in SCFI was mainly concentrated on the European and Mediterranean routes, with the largest decline. Among them, the freight rate from the Far East to the Mediterranean has fallen below the $3,000 mark, and the route has plunged 12.18%, becoming the most significant decline among the four major routes. In addition, the European route fell by 8.76%, while the US-East route fell by 5.15%. In contrast, the US-West route saw a smaller decline of 2.78 per cent.

Specifically, the market focus is on the impasse in the labor negotiations between the United States East and Mexico Bay Terminal, and the labor side plans to launch a general strike on October 1, which further aggravates the market uncertainty. In the face of this situation, shipping companies and shippers have taken countermeasures, some shippers choose to divert the United States East cargo to the United States West, while some choose to suspend shipments to see how the situation develops. These measures have eased the downward pressure on freight rates on the West line to some extent, but the freight rate on the East line per 40 feet container has fallen sharply by more than $1,000 in two weeks.

In response to the potential strike risk, a number of shipping companies have announced plans to impose surcharges on the United States East and Mexico Bay routes, such as CMA CGM ships will charge a "port surcharge" (LPC) from October 11, $1,500 per 20-foot container and $3,000 per 40-foot container. Hapag-lloyd is set to impose an "interruption surcharge" (WDS) of $1,000 per 20-foot container starting Oct. 18 to cover possible increased operating costs.

Despite the continued decline in freight rates, Evergreen Shipping remains optimistic about the freight market in the fourth quarter and next year. The ongoing impact of the Red Sea crisis, shipping delays at ports in North America and Asia, and the early Lunar New Year in 2025 will combine to maintain the stability of cargo volumes and drive a stable correction in freight rates.

People in the logistics industry pointed out that the current freight rate does not truly reflect the market situation, with the clear risk of strike at the East terminal and the increase in shipping demand after the 11th holiday, it is expected that there will be a new pattern of changes in freight rates from October.

In addition, this year's labor negotiations on the East Coast of the United States pose significant challenges to the shipping industry, and coupled with the complex situation in the United States in an election year, shipping companies and logistics operators need to remain on high alert and closely monitor the progress of negotiations. For European routes, the Red Sea crisis may cause ships to sail around the Cape of Good Hope in South Africa to become the norm, which will increase the operating costs of shipping companies. The market predicts that with the consideration of cost effectiveness, some small ships may withdraw from the market due to the inability to adapt to market changes, which will help promote the healthy development of the shipping market.

SCFI index

Shanghai to Europe line freight 2,592 US dollars /TEU, down 249 US dollars, down 8.76%;

Shanghai to Mediterranean freight 2,955 USD /TEU, down 410 USD or 12.18%;

Shanghai to the United States West freight 5341 US dollars /FEU, week down 153 US dollars, down 2.78%;

Shanghai to the United States East freight 6486 US dollars /FEU, down 352 US dollars, a decline of 5.15%.

Persian Gulf route freight of $1,147, down $117, or 9.26%;

South American route (Santos) freight of $6,990, down $311, or 4.26%.

Southeast Asia Line (Singapore) freight 412 US dollars, down 35 US dollars, or 7.83%.

WCI index

WCI fell 5% this week to $3,970 per large box (40-foot container), 62% below the September 2021 peak of $10,377 during the pandemic, but still 180% above the pre-pandemic 2019 average rate of $1,420.

The year-to-date average composite index is $4,124 per large box, $1,302 higher than the 10-year average rate of $2,821. Freight rates from Shanghai to Rotterdam plunged 9 percent this week, or $470 per large box, to $4,682. Freight from Shanghai to Genoa fell 6 percent, or $328, to $4,928. Similarly, prices from Shanghai to New York dropped 4 percent, or $297 to $6,364 per large case. In addition, the spot freight rate from Shanghai to Los Angeles dropped 1%, down 47 dollars to 5,580 dollars.

While the looming American East International Longshoremen's Association (ILA) port strike cast a shadow, trans-Pacific eastbound freight rates fell slightly this week. Delury expects weak demand to drive rates down further in the eastern and western spot markets in the coming weeks.

According to Delury's latest cancellation tracking data, during the 39th week (September 23 to September 29) and 43rd week (October 21 to October 27), out of 693 scheduled sailings on major trans-Pacific, trans-Atlantic and Asian east-west routes to Northern Europe and the Mediterranean, shipping lines announced a total of 105 cancellations. The cancellation rate is 15%. During this period, 64 percent of empty voyages will be on trans-Pacific eastbound routes, 24 percent on Asia-Nordic and Mediterranean routes, and 12 percent on trans-Atlantic westbound routes.

'The reliability of shipping schedules is declining,' Mr. Delury said. An average of 85% of ships are expected to depart on schedule in the next five weeks.

Freight rates on key East-West trade routes continue to fall due to sluggish demand. On Sept. 19, Delury's WCI Composite Index fell 5% week over week to $3,970 per 40-foot container. Trans-pacific freight rates fell 8%, Asia-Nordic/Mediterranean freight rates fell 3%, while trans-Atlantic freight rates rose 2%.

The East Coast of the US is facing a possible strike within two weeks as negotiations stall and unions refuse to accept government arbitration. Alternative terminals on the West coast of Canada and the United States may struggle to handle diverted East Coast cargoes, and some shippers have moved ahead to divert cargoes to avoid disruption.

In light of this, Delury reminds shippers and Beneficial Cargo Owners (BCOs) to be vigilant against possible increases in the cost of shipping goods to the East Coast of the United States, the Gulf Coast, the Caribbean, Mexico and Canada. In fact, several carriers have announced that emergency operating surcharges will be implemented from next month in response to the upcoming challenges, which will directly drive up the related transport costs. Therefore, all parties need to plan and prepare in advance to deal with possible market changes.