Operating costs have increased and a number of shipping giants have announced new surcharges

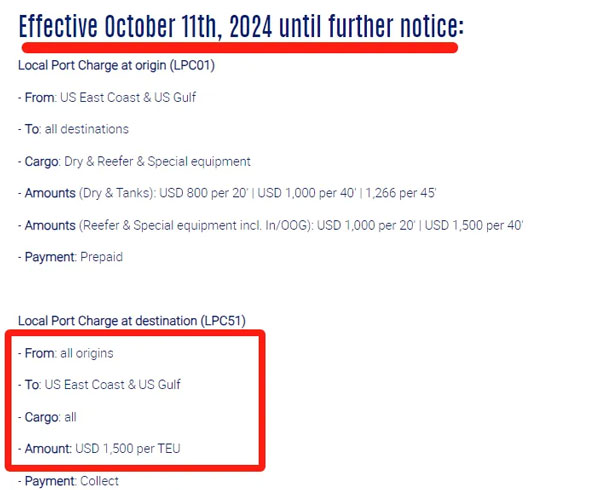

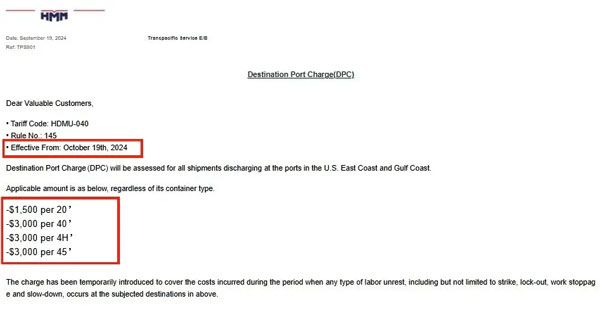

With the increasing risk of port strikes in the eastern United States and the Gulf Coast, following MSC, container shipping companies serving the region, CMA CGM, Hapal-Lloyd, HMM, etc., have announced that they will impose disruption surcharges and destination surcharges to deal with potential operating costs.

Us East Strike Imminent! On September 1, MSC first informed customers that, effective October 1 (the day the strike began), an Emergency operations surcharge (EOS) of $1,000 per 20-foot container and $1,500 per 40-foot container will be added to all shipments to ports in the eastern United States, the Gulf Coast, the Caribbean, Mexico and Canada, respectively. The move is in line with federal maritime regulations, which require the industry to be notified at least 30 days before fees are implemented.

A prolonged strike on the U.S. East coast that stranded ships could take five to seven weeks to return to Asia would severely disrupt the peak shipping season ahead of the Lunar New Year holiday, with far-reaching implications for Asia, Jensen said. He noted that the experience during the pandemic had taught shipping companies how to set prices when capacity was tight, moving beyond the cost-plus model and allowing them to increase rates more flexibly and quickly.

Meanwhile, new analysis from supply chain visualization platform FourKites suggests that the U.S. auto and agriculture industries would be particularly vulnerable in the face of a prolonged strike. Mike DeAngelis, director of FourKites International Solutions, pointed out that auto and agricultural exporters could face serious challenges, with a sharp drop in agricultural exports likely to push up food prices in countries that rely on U.S. agricultural products, while the auto industry could experience increased supply chain problems, leading to production slowdowns and even plant closures. In addition, the strike could trigger inventory shortages, affecting the holiday shopping season and the achievement of year-end manufacturing targets.

Us East Strike Imminent! On September 1, MSC first informed customers that, effective October 1 (the day the strike began), an Emergency operations surcharge (EOS) of $1,000 per 20-foot container and $1,500 per 40-foot container will be added to all shipments to ports in the eastern United States, the Gulf Coast, the Caribbean, Mexico and Canada, respectively. The move is in line with federal maritime regulations, which require the industry to be notified at least 30 days before fees are implemented.

A prolonged strike on the U.S. East coast that stranded ships could take five to seven weeks to return to Asia would severely disrupt the peak shipping season ahead of the Lunar New Year holiday, with far-reaching implications for Asia, Jensen said. He noted that the experience during the pandemic had taught shipping companies how to set prices when capacity was tight, moving beyond the cost-plus model and allowing them to increase rates more flexibly and quickly.

Meanwhile, new analysis from supply chain visualization platform FourKites suggests that the U.S. auto and agriculture industries would be particularly vulnerable in the face of a prolonged strike. Mike DeAngelis, director of FourKites International Solutions, pointed out that auto and agricultural exporters could face serious challenges, with a sharp drop in agricultural exports likely to push up food prices in countries that rely on U.S. agricultural products, while the auto industry could experience increased supply chain problems, leading to production slowdowns and even plant closures. In addition, the strike could trigger inventory shortages, affecting the holiday shopping season and the achievement of year-end manufacturing targets.