In 2030, the aging problem of large ships is more significant

For the rest of the 2020s, the global merchant fleet will face an inevitable trend: the gradual aging of ships. This will be the new normal for charterers, operators and shipowners, especially as scrapping volumes continue to be low and many existing vessels reach "old age" in the coming years.

According to the latest report by Greek ship broker Xclusiv, a large number of existing ships will reach the age of more than 20 years in the next few years.

In the dry bulk sector, Xclusiv's data indicates that by 2030, nearly 30% of the ships and capacity in the existing fleet will be more than 20 years old, and the aging problem is particularly significant for large ships. At the same time, the tanker fleet is facing a similar aging trend. It is expected that by 2030, about 48% of the existing tanker fleet (by deadweight ton) will be over 21 years old.

According to Alphaliner's data, the world's top 10 container shipping lines still operate 683 vessels over 20 years old, providing a capacity of more than 2.6 million TEUs. Assuming a normal commercial life of 25 years for cargo ships, these figures suggest that the top 10 operators may need to spend 44% of their orders on replacing ageing vessels rather than expanding capacity.

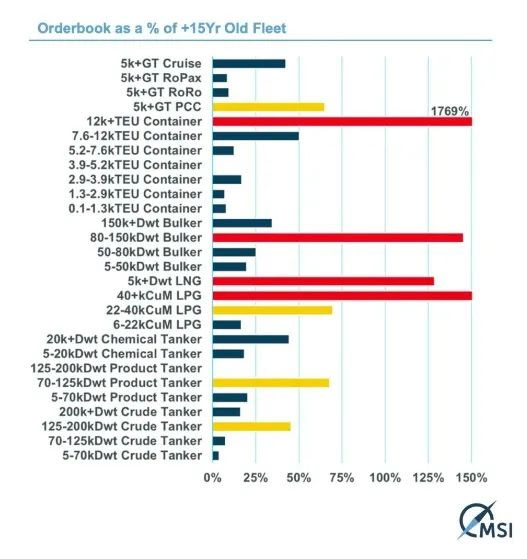

Looking ahead to the next few years, several aging shipping sectors will face an obvious bottleneck: they need to renew their fleets, but Asian yards are already full of orders for container ships and gas carriers, leaving limited resources for new construction. This imbalance between supply and demand indicates that shipowners and operators will face more serious choices.

According to the latest report by Greek ship broker Xclusiv, a large number of existing ships will reach the age of more than 20 years in the next few years.

In the dry bulk sector, Xclusiv's data indicates that by 2030, nearly 30% of the ships and capacity in the existing fleet will be more than 20 years old, and the aging problem is particularly significant for large ships. At the same time, the tanker fleet is facing a similar aging trend. It is expected that by 2030, about 48% of the existing tanker fleet (by deadweight ton) will be over 21 years old.

According to Alphaliner's data, the world's top 10 container shipping lines still operate 683 vessels over 20 years old, providing a capacity of more than 2.6 million TEUs. Assuming a normal commercial life of 25 years for cargo ships, these figures suggest that the top 10 operators may need to spend 44% of their orders on replacing ageing vessels rather than expanding capacity.

Looking ahead to the next few years, several aging shipping sectors will face an obvious bottleneck: they need to renew their fleets, but Asian yards are already full of orders for container ships and gas carriers, leaving limited resources for new construction. This imbalance between supply and demand indicates that shipowners and operators will face more serious choices.