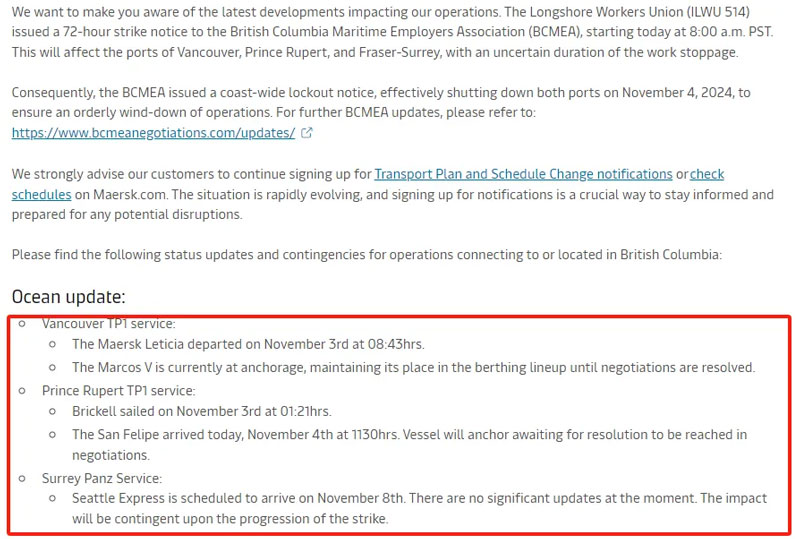

Maersk has issued a warning after a wave of strikes in Canada affected several ports

The recent strike in Canadian ports has led to the closure of major ports such as Vancouver and Prince Rupert Port, triggering a chain reaction in shipping, including the routes of many companies such as Maersk, and the risk of price increases and delays in cargo intermodal transport, while the Port of Montreal is also blocked due to automation disputes, leading to the diversion of ports on the West Coast of the United States may become a trend, but may exacerbate its traffic congestion.

Jena Santoro, senior manager of solutions at Everstream Analytics, a global supply chain insight and risk analysis firm, warned that subsequent interconnections from Vancouver could be affected by a shortage of truck drivers and delays in the delivery of goods, leading to higher prices. She noted that the current backlog of ships at the Port of Vancouver has increased significantly, while other Canadian ports such as Prince Rupert and even Halifax on the East Coast are showing a similar upward trend.

On Canada's east coast, the Port of Montreal's Termont terminal, which accounts for 40 per cent of the port's container traffic, has been locked down since October 31. Harold Daggett, president of the International Longshoremen's Association (ILA), said on the 4th that the battle against job-killing automation is raging at the Port of Montreal.

Daggett stressed that more than 1,000 members of ILA Local 1657 would be at risk of losing their jobs if the plan is implemented. Donald Beerworth, business agent for ILA Local 1657, added that this would result in the loss of at least half of ILA members for technical reasons.

With shipping disruptions on Canada's east and west coasts at the same time, and fears of another strike action at US eastern and Gulf Coast ports in the New Year, Santoro said a reroute to US west Coast ports was "the most likely scenario". However, she also warned that the diversion could lead to increased traffic congestion and cargo processing backlogs at ports such as Seattle, Oakland and even further south in Los Angeles and Long Beach.

Jena Santoro, senior manager of solutions at Everstream Analytics, a global supply chain insight and risk analysis firm, warned that subsequent interconnections from Vancouver could be affected by a shortage of truck drivers and delays in the delivery of goods, leading to higher prices. She noted that the current backlog of ships at the Port of Vancouver has increased significantly, while other Canadian ports such as Prince Rupert and even Halifax on the East Coast are showing a similar upward trend.

On Canada's east coast, the Port of Montreal's Termont terminal, which accounts for 40 per cent of the port's container traffic, has been locked down since October 31. Harold Daggett, president of the International Longshoremen's Association (ILA), said on the 4th that the battle against job-killing automation is raging at the Port of Montreal.

Daggett stressed that more than 1,000 members of ILA Local 1657 would be at risk of losing their jobs if the plan is implemented. Donald Beerworth, business agent for ILA Local 1657, added that this would result in the loss of at least half of ILA members for technical reasons.

With shipping disruptions on Canada's east and west coasts at the same time, and fears of another strike action at US eastern and Gulf Coast ports in the New Year, Santoro said a reroute to US west Coast ports was "the most likely scenario". However, she also warned that the diversion could lead to increased traffic congestion and cargo processing backlogs at ports such as Seattle, Oakland and even further south in Los Angeles and Long Beach.