Three Questions: Understanding the US's Suppression of Chinese Shipping

A packed public hearing is taking place at the U.S. International Trade Commission building at 500 SE Street in Washington, DC. This is the closely watched public hearing on the Section 301 investigation into China's shipping, logistics and shipbuilding industries, which had to be extended from one day to two because of the overwhelming number of applicants.

The proposed measures include: a maximum charge of $1 million per vessel per entry into a U.S. port by Chinese shipping companies (the same below), or a charge of $1,000 per vessel per net ton per entry, depending on the vessel's deadweight; For Chinese-made vessels owned by non-Chinese shipping companies, a maximum charge of US $1.5 million per vessel, or US $500,000 to US $1 million per vessel, depending on the proportion of Chinese-made vessels in the fleet; For shipping companies that order ships from China or receive ships ordered from China in the next two years, each ship will be charged between $500,000 and $1 million, depending on the proportion of ships ordered.

In addition, after the implementation of the measure, at least 1 percent of U.S. goods each year must be shipped on U.S.-flagged vessels operated by U.S. shipping companies, increasing to 3 percent after two years and 5 percent after three years, and 3 percent of these must be operated by U.S.-made vessels, increasing to 15 percent and 5 percent after seven years, respectively.

It is just that the US has made a wrong calculation and this move has hurt others and itself. Since Trump has always shouted the slogan of "America first", it is necessary to ask: Can charging revitalize the US shipbuilding industry? Are fees in corporate America's interest?

Q: Can tolls revive the U.S. shipbuilding industry?

The most direct target of USTR's proposed measures is the Chinese shipbuilding industry. USTR believes that the current global dominance of China's shipbuilding industry is unjustified because it reduces competition and creates market dependence on China.

Consider the success of the Chinese shipbuilding industry and the decline of the American shipbuilding industry.

Before 1978, China's shipbuilding industry was still in the stage of turnkey management under the planned economy system. Due to the downturn in the domestic ship market at that time, shipyards had to shift from the production of military supplies under the planned economy system to the marketization based on civilian industry and aiming at the international market.

In the early stage of development, China's shipbuilding industry faced a dilemma of orders, production capacity and technology "from 0 to 1". Finally, under heavy pressure, Dalian Shipyard after difficult exploration, achieved 18 months of on-time delivery of the ship, and passed the acceptance with almost "zero error". This is the first time that China has proven its shipbuilding capabilities to the international market.

Continuous technological innovation and open cooperation, active integration into the world pattern, and dedication to shaping an industrial system for common development are the reasons why China's shipbuilding industry is in the leading position in the world.

In contrast, the U.S. shipbuilding industry was the world's largest 50 years ago, but the protectionist regulations imposed by the United States required that ships used to transport goods in the United States be built in the United States. This avoids competition and allows the US shipbuilding industry to have stable orders, but without competition, how can progress be made? The result was high ship construction costs and low productivity, limiting the potential of the U.S. shipbuilding industry. The US government also tried to bridge the gap in shipbuilding costs by providing large subsidies to US shipbuilders, which ultimately backfired.

It is not difficult to see that the United States has repeatedly hoped to "flourish" the shipbuilding industry through protectionism, but what it has raised is a group of "giant baby" shipyards that will only lie flat. Behind this, there are a series of problems such as labor fault, lack of industrial chain, and cost inversion, which are closely related to the structural contradictions of the US economy. At the same time, the decline of the US shipbuilding industry long before the rise of the Chinese shipbuilding industry, blaming the decline of the US shipbuilding industry on China is nonsense, and allowing ships to quickly move to the US production is tantamount to wishful thinking.

As the China Shipbuilding Industry Association said in its submission to the USTR: "We are open to U.S. efforts to revive the shipbuilding industry, but oppose any practices that suppress and harm the shipping industry in China and the world." "The Chinese shipbuilding industry is always committed to cooperation, opposes repression and will respond to any challenges."

The way for the United States to revitalize the shipbuilding industry is not to develop itself, but to protectionism and suppress rivals, which has been proved by history to be unworkable and doomed to fail again.

Q: Is charging in the interest of American companies?

Since the "Trump 1.0", the United States, under the slogan of "America First", has gone against the trend of globalization, and in the end, it can only harm others but benefit itself.

When the USTR launched the 301 investigation on China's shipping, logistics and shipbuilding industry, it did receive support from some domestic organizations in the United States, but in the two hearings and the previous solicitation of opinions, more American association organizations and enterprises voiced their opposition.

In the area of imports and exports, several associations have expressed concerns about the proposed measures.

The National Retail Federation (NRF), the world's largest retail trade association, believes that while the charges are targeted at shipping companies, the associated costs will be passed on to shippers, resulting in hundreds of dollars in additional shipping costs per container at a time of ongoing supply chain stress. In addition, the fee will force shipping companies to reroute routes out of some U.S. ports, straining the U.S. market, or divert routes to Canadian or Mexican ports, forcing shippers to bear additional costs.

The National Mining Association (NMA) also suggested that the charges could have serious consequences for the US mining industry, because the industry is highly dependent on global shipping networks, cost surges, supply chain strains and even the import and export of key materials will lead to stagnation, which will threaten US manufacturing, energy production and national security.

For small U.S. importers and exporters, small shipping companies, and smaller ports, the impact could be devastating.

An American importer and exporter simply shouted: "BAD IDEA! VERY BAD!" Because the company works with shipping companies whose ships are made in China, the implementation of the proposed measures could lead to the company's outright collapse. The Atlantic Container Line, which trades across the Atlantic, speaks for America's small shipping companies. The company's CEO said bluntly that if it charged, the company's American routes would be forced to shut down and dismiss its American employees. He also believes that the relevant measures will not help the U.S. shipbuilding industry, shipbuilding orders will only turn to South Korea, Japan. A smaller container terminal in Miami also said that shipping companies would save money by no longer relying on small terminals, dock and trailer companies were out of work, and the infrastructure investment in the terminal was wasted.

Clearly, the proposed measures directly drive up transportation costs and increase the price of goods in the United States. The United States is a major exporter of food, agricultural products and energy, and once the cost increases, it will undoubtedly reduce its competitiveness in the global market, causing US farmers, retailers, manufacturers, consumers and other groups to suffer huge losses. Is this in the interest of American business?

Three questions: Can suppressing China's shipping, logistics, and shipbuilding industries promote the US economy?

The essence of the proposed measure, a tax on U.S. imports and exports, would have a significant negative impact on the U.S. economy and contradict USTR's stated objectives. After the tariff stick failed to achieve the desired effect, the United States attempted to stir up the global supply chain, but this is more like shooting itself in the foot.

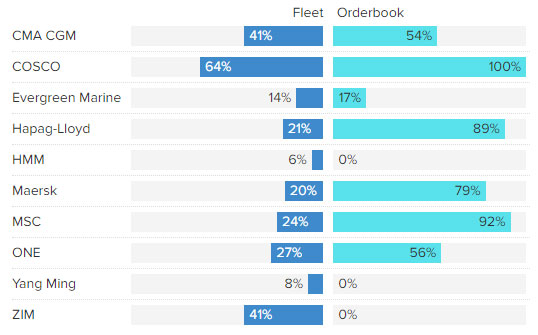

According to Clarkson's statistics, Chinese-made vessels account for 23 per cent of the global fleet, with bulk carriers accounting for 48 per cent, container ships 39 per cent and oil tankers 28 per cent. At the same time, Chinese shipyards hold 61 percent of the world's orders, including 73 percent for container ships, 71 percent for tankers and 69 percent for bulk carriers.

MSC CEO Soren Toft has issued a clear warning that if the proposed measures are implemented, it will be American consumers who end up footing the bill. "We don't have any other options and will have to rethink route coverage and increase costs, which will be passed on to the end consumer if the costs are not covered by freight," he said. It will also look at reorganising the route network to shift capacity away from less profitable routes and towards more profitable routes."

The Baltic International Chamber of Shipping (BIMCO) also analyzed that some liner companies may remove Chinese-made vessels from their fleets and focus their business on the US market, while others may increase the proportion of Chinese-made vessels and focus their business on non-US markets. As the market is fragmented and competition is reduced, the total cost of shipping will increase. BIMCO's final conclusion is that the proposed measures will significantly increase transportation costs for U.S. import and export trade and negatively impact the broader U.S. economy, but the impact on China's position in the relevant market is uncertain.

China's position is clear.

"We urge the US side to respect facts and multilateral rules, immediately stop its wrong practices, and China will take necessary measures to defend its legitimate rights and interests," she stressed.

The China Shipowners Association made clear that the chain reaction triggered by the proposed measures could shake the foundation of international trade, ripple through global supply chains and weaken supply chain resilience. The Chinese Shipowners Association urges USTR to negotiate in good faith with Chinese government agencies to resolve the current dispute through existing channels such as the WTO and the US-China Maritime Agreement.

The proposed measures include: a maximum charge of $1 million per vessel per entry into a U.S. port by Chinese shipping companies (the same below), or a charge of $1,000 per vessel per net ton per entry, depending on the vessel's deadweight; For Chinese-made vessels owned by non-Chinese shipping companies, a maximum charge of US $1.5 million per vessel, or US $500,000 to US $1 million per vessel, depending on the proportion of Chinese-made vessels in the fleet; For shipping companies that order ships from China or receive ships ordered from China in the next two years, each ship will be charged between $500,000 and $1 million, depending on the proportion of ships ordered.

In addition, after the implementation of the measure, at least 1 percent of U.S. goods each year must be shipped on U.S.-flagged vessels operated by U.S. shipping companies, increasing to 3 percent after two years and 5 percent after three years, and 3 percent of these must be operated by U.S.-made vessels, increasing to 15 percent and 5 percent after seven years, respectively.

It is just that the US has made a wrong calculation and this move has hurt others and itself. Since Trump has always shouted the slogan of "America first", it is necessary to ask: Can charging revitalize the US shipbuilding industry? Are fees in corporate America's interest?

Q: Can tolls revive the U.S. shipbuilding industry?

The most direct target of USTR's proposed measures is the Chinese shipbuilding industry. USTR believes that the current global dominance of China's shipbuilding industry is unjustified because it reduces competition and creates market dependence on China.

Consider the success of the Chinese shipbuilding industry and the decline of the American shipbuilding industry.

Before 1978, China's shipbuilding industry was still in the stage of turnkey management under the planned economy system. Due to the downturn in the domestic ship market at that time, shipyards had to shift from the production of military supplies under the planned economy system to the marketization based on civilian industry and aiming at the international market.

In the early stage of development, China's shipbuilding industry faced a dilemma of orders, production capacity and technology "from 0 to 1". Finally, under heavy pressure, Dalian Shipyard after difficult exploration, achieved 18 months of on-time delivery of the ship, and passed the acceptance with almost "zero error". This is the first time that China has proven its shipbuilding capabilities to the international market.

Continuous technological innovation and open cooperation, active integration into the world pattern, and dedication to shaping an industrial system for common development are the reasons why China's shipbuilding industry is in the leading position in the world.

In contrast, the U.S. shipbuilding industry was the world's largest 50 years ago, but the protectionist regulations imposed by the United States required that ships used to transport goods in the United States be built in the United States. This avoids competition and allows the US shipbuilding industry to have stable orders, but without competition, how can progress be made? The result was high ship construction costs and low productivity, limiting the potential of the U.S. shipbuilding industry. The US government also tried to bridge the gap in shipbuilding costs by providing large subsidies to US shipbuilders, which ultimately backfired.

It is not difficult to see that the United States has repeatedly hoped to "flourish" the shipbuilding industry through protectionism, but what it has raised is a group of "giant baby" shipyards that will only lie flat. Behind this, there are a series of problems such as labor fault, lack of industrial chain, and cost inversion, which are closely related to the structural contradictions of the US economy. At the same time, the decline of the US shipbuilding industry long before the rise of the Chinese shipbuilding industry, blaming the decline of the US shipbuilding industry on China is nonsense, and allowing ships to quickly move to the US production is tantamount to wishful thinking.

As the China Shipbuilding Industry Association said in its submission to the USTR: "We are open to U.S. efforts to revive the shipbuilding industry, but oppose any practices that suppress and harm the shipping industry in China and the world." "The Chinese shipbuilding industry is always committed to cooperation, opposes repression and will respond to any challenges."

The way for the United States to revitalize the shipbuilding industry is not to develop itself, but to protectionism and suppress rivals, which has been proved by history to be unworkable and doomed to fail again.

Q: Is charging in the interest of American companies?

Since the "Trump 1.0", the United States, under the slogan of "America First", has gone against the trend of globalization, and in the end, it can only harm others but benefit itself.

When the USTR launched the 301 investigation on China's shipping, logistics and shipbuilding industry, it did receive support from some domestic organizations in the United States, but in the two hearings and the previous solicitation of opinions, more American association organizations and enterprises voiced their opposition.

In the area of imports and exports, several associations have expressed concerns about the proposed measures.

The National Retail Federation (NRF), the world's largest retail trade association, believes that while the charges are targeted at shipping companies, the associated costs will be passed on to shippers, resulting in hundreds of dollars in additional shipping costs per container at a time of ongoing supply chain stress. In addition, the fee will force shipping companies to reroute routes out of some U.S. ports, straining the U.S. market, or divert routes to Canadian or Mexican ports, forcing shippers to bear additional costs.

The National Mining Association (NMA) also suggested that the charges could have serious consequences for the US mining industry, because the industry is highly dependent on global shipping networks, cost surges, supply chain strains and even the import and export of key materials will lead to stagnation, which will threaten US manufacturing, energy production and national security.

For small U.S. importers and exporters, small shipping companies, and smaller ports, the impact could be devastating.

An American importer and exporter simply shouted: "BAD IDEA! VERY BAD!" Because the company works with shipping companies whose ships are made in China, the implementation of the proposed measures could lead to the company's outright collapse. The Atlantic Container Line, which trades across the Atlantic, speaks for America's small shipping companies. The company's CEO said bluntly that if it charged, the company's American routes would be forced to shut down and dismiss its American employees. He also believes that the relevant measures will not help the U.S. shipbuilding industry, shipbuilding orders will only turn to South Korea, Japan. A smaller container terminal in Miami also said that shipping companies would save money by no longer relying on small terminals, dock and trailer companies were out of work, and the infrastructure investment in the terminal was wasted.

Clearly, the proposed measures directly drive up transportation costs and increase the price of goods in the United States. The United States is a major exporter of food, agricultural products and energy, and once the cost increases, it will undoubtedly reduce its competitiveness in the global market, causing US farmers, retailers, manufacturers, consumers and other groups to suffer huge losses. Is this in the interest of American business?

Three questions: Can suppressing China's shipping, logistics, and shipbuilding industries promote the US economy?

The essence of the proposed measure, a tax on U.S. imports and exports, would have a significant negative impact on the U.S. economy and contradict USTR's stated objectives. After the tariff stick failed to achieve the desired effect, the United States attempted to stir up the global supply chain, but this is more like shooting itself in the foot.

According to Clarkson's statistics, Chinese-made vessels account for 23 per cent of the global fleet, with bulk carriers accounting for 48 per cent, container ships 39 per cent and oil tankers 28 per cent. At the same time, Chinese shipyards hold 61 percent of the world's orders, including 73 percent for container ships, 71 percent for tankers and 69 percent for bulk carriers.

MSC CEO Soren Toft has issued a clear warning that if the proposed measures are implemented, it will be American consumers who end up footing the bill. "We don't have any other options and will have to rethink route coverage and increase costs, which will be passed on to the end consumer if the costs are not covered by freight," he said. It will also look at reorganising the route network to shift capacity away from less profitable routes and towards more profitable routes."

The Baltic International Chamber of Shipping (BIMCO) also analyzed that some liner companies may remove Chinese-made vessels from their fleets and focus their business on the US market, while others may increase the proportion of Chinese-made vessels and focus their business on non-US markets. As the market is fragmented and competition is reduced, the total cost of shipping will increase. BIMCO's final conclusion is that the proposed measures will significantly increase transportation costs for U.S. import and export trade and negatively impact the broader U.S. economy, but the impact on China's position in the relevant market is uncertain.

China's position is clear.

"We urge the US side to respect facts and multilateral rules, immediately stop its wrong practices, and China will take necessary measures to defend its legitimate rights and interests," she stressed.

The China Shipowners Association made clear that the chain reaction triggered by the proposed measures could shake the foundation of international trade, ripple through global supply chains and weaken supply chain resilience. The Chinese Shipowners Association urges USTR to negotiate in good faith with Chinese government agencies to resolve the current dispute through existing channels such as the WTO and the US-China Maritime Agreement.

By swinging the stick in the area of tariffs and shipping, the United States will once again undermine the basic trust of the world in global trade. If the United States goes its own way, it will affect all aspects of the global supply chain, thus affecting the stability of the global industrial structure and market. In the long run, the overall "de-Americanization" of global trade will accelerate.

This article is reproduced from: China Shipping Gazette, if involved in infringement please contact us to delete.