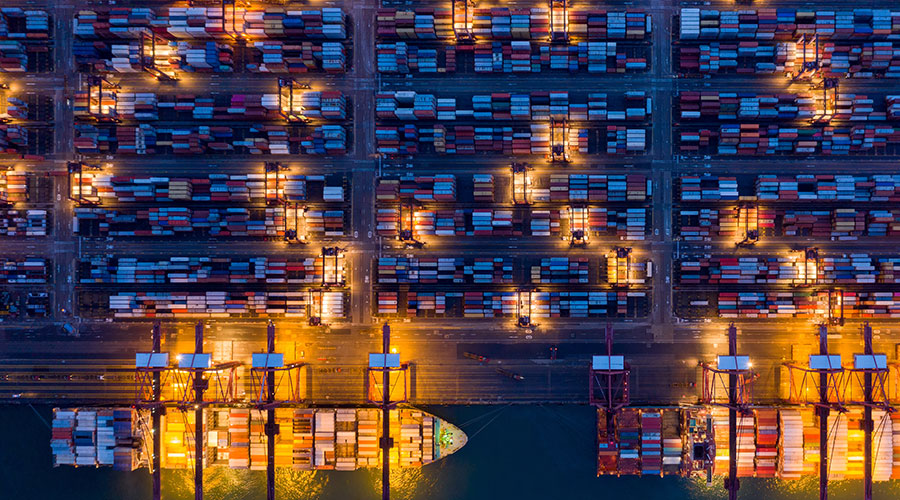

A preliminary hearing in the Office of the United States Trade Representative's (USTR) investigation into China's shipping market manipulation has not been warmly received by industry operators and their customers.

At a hearing Monday at the U.S. Trade Representative's office, U.S. shippers' representative groups largely opposed imposing a $1.5 million fee per port call on Chinese ships, arguing that the move would exacerbate cost increases and eventually spark inflation as shipping costs are passed on to consumers.

The World Shipping Council's statement also highlighted the inflationary trend: "The World Shipping Council (WSC), which represents 90 percent of global container ship capacity, submitted a prepared testimony arguing that these fees will exacerbate supply chain inefficiencies and negatively impact U.S. operations," Alphaliner reported.

At the same time, the National Council of Farmers Cooperatives believes that increased transportation costs will seriously affect the competitiveness of the U.S. industry in the global market.

Feeder operators, U.S. terminal operators and China's trade representative predictably opposed the proposed fees.

However, as expected, a number of trade associations supported the policy, including the American Manufacturing Alliance (AAM), which is backed by the U.S. steel industry, as did South Korea's Hanwha Shipping and its U.S. subsidiary.

According to Alphaliner, the AAM agrees with the Trump administration that China manipulates the market: "The biggest obstacle to the U.S. shipbuilding industry is China's unfair trade practices." While no country should be faulted for seeking to develop maritime capabilities, Beijing's ambitions go far beyond that and merit a strong response from USTR using its authority."

Carl Bentzel, a former federal commissioner of Marine companies and now president of the National Association of Coastal Employers (NAWE), sees European, Japanese and Korean shipbuilders as acceptable alternatives that could bring their expertise to the United States to revitalize the U.S. shipbuilding industry.

"They need to build ships in the US, but these shipbuilders know it will ultimately benefit their companies," Mr Benzel told Seatrade Maritime News.

At the same time, Alphaliner argued that the fees, if imposed, would distort the liner transport trade as larger operators are better able to limit their risks.

There are big differences among carriers. Neither Evergreen nor Hyundai Merchant Marine has made port calls using Chinese-built vessels, while Maersk Line has made 38 of 214 port calls, Star Line has made 37 of 73 port calls and CMA CGM has made 139 port calls. Chinese-built vessels accounted for 36 of them, 34 of 218 port calls for Mediterranean shipping, and 25 of 72 port calls for COSCO.

The policy could be particularly damaging for Star Shipping, as 48 percent of its fleet is deployed on U.S. routes. "Most of the Chinese-built vessels in Esstar's fleet are between 5,315 and 7,800 teu deadweight and have only recently been on long-term charters from owners such as Seaspan or Navios," Alphaliner said.

Alphaliner said 1,002 vessels called at ports in February, of which 190 (19 percent) were built by China, with a total of 488 vessels docked. Alphaliner also said that the majority of container ships serving the United States were built by South Korea, accounting for 54.5 percent, while Chinese vessels accounted for 20.9 percent and Japanese vessels accounted for 12.3 percent.